How to use

the Balanced app

Learn how to borrow bnUSD, swap and supply crypto, transfer between blockchains, and more.

Sign in to the Balanced app with a compatible browser wallet, or access it through the Hana wallet on iOS and Android.

Borrow Balanced Dollars.

The Balanced Dollar (bnUSD) is a decentralised stablecoin that tracks the price of 1 US dollar. You can borrow bnUSD against any supported collateral type, and use it wrapper-free on every blockchain Balanced connects to. There’s a ... fee, and your loan will increase by 2% a year.

Learn more about the Balanced stablecoin.

1. Deposit collateral

You can deposit a variety of assets as collateral. Each collateral type represents a separate position with its own risk profile.

From the Collateral section on the Home page:

- Choose a collateral type and blockchain to use.

- Click Deposit and enter the amount.

- Check the Loan section to see how many bnUSD you can borrow.

- Click Confirm and complete the transaction.

The same asset on multiple blockchains = multiple positions. If you deposit ETH on Arbitrum and Base, you have two positions, so you can borrow against your Arbitrum ETH without putting your Base ETH at risk.

2. Take out a loan

Borrow bnUSD against your collateral, which you can receive and repay from any supported blockchain.

Make sure the correct collateral type is active, then, from the Loan section:

- Choose which blockchain to use.

- Click Borrow and enter the amount.

- Use the Position Details section to assess your risk.

- Click Confirm and complete the transaction.

A loan puts your collateral at risk.

Your risk increases when the USD value of your collateral drops. If it ever falls below ... of your loan (... loan-to-value ratio), it will be partially liquidated to reduce your risk.

Keep an eye on your risk from the Position Details section.

3. Monitor your position

Use the Position Details section to monitor your risk and adjust each loan position. It includes the price your collateral type needs to reach to trigger liquidation, so you can assess your risk against the market.

To lower your risk ratio, reduce your loan or deposit more collateral.

Use the decentralised exchange.

Balanced includes a decentralised exchange so you can swap crypto, supply liquidity, and transfer value across chains.

Swap assets

You can trade your crypto for a range of assets, and move value between blockchains in 30 seconds.

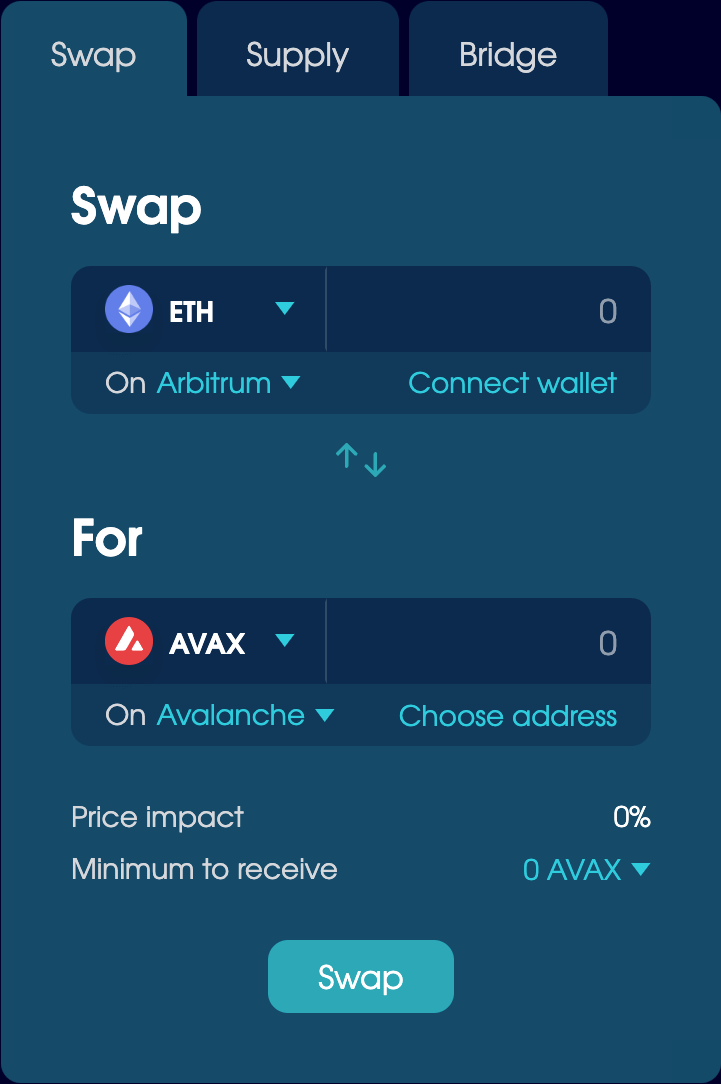

From the Swap tab on the Trade page:

- Choose which assets to swap and receive.

- Choose which blockchains to send and receive on, and adjust the recipient address if needed.

- Enter the amount, then click Swap and complete the transaction.

If your trade fails or takes more than 5 minutes, it will auto-cancel and return your funds.

Supply liquidity Legacy

Supply liquidity on any connected chain to improve the Balanced trading experience. Liquidity pools receive ... of the trading fees, and some offer incentives.

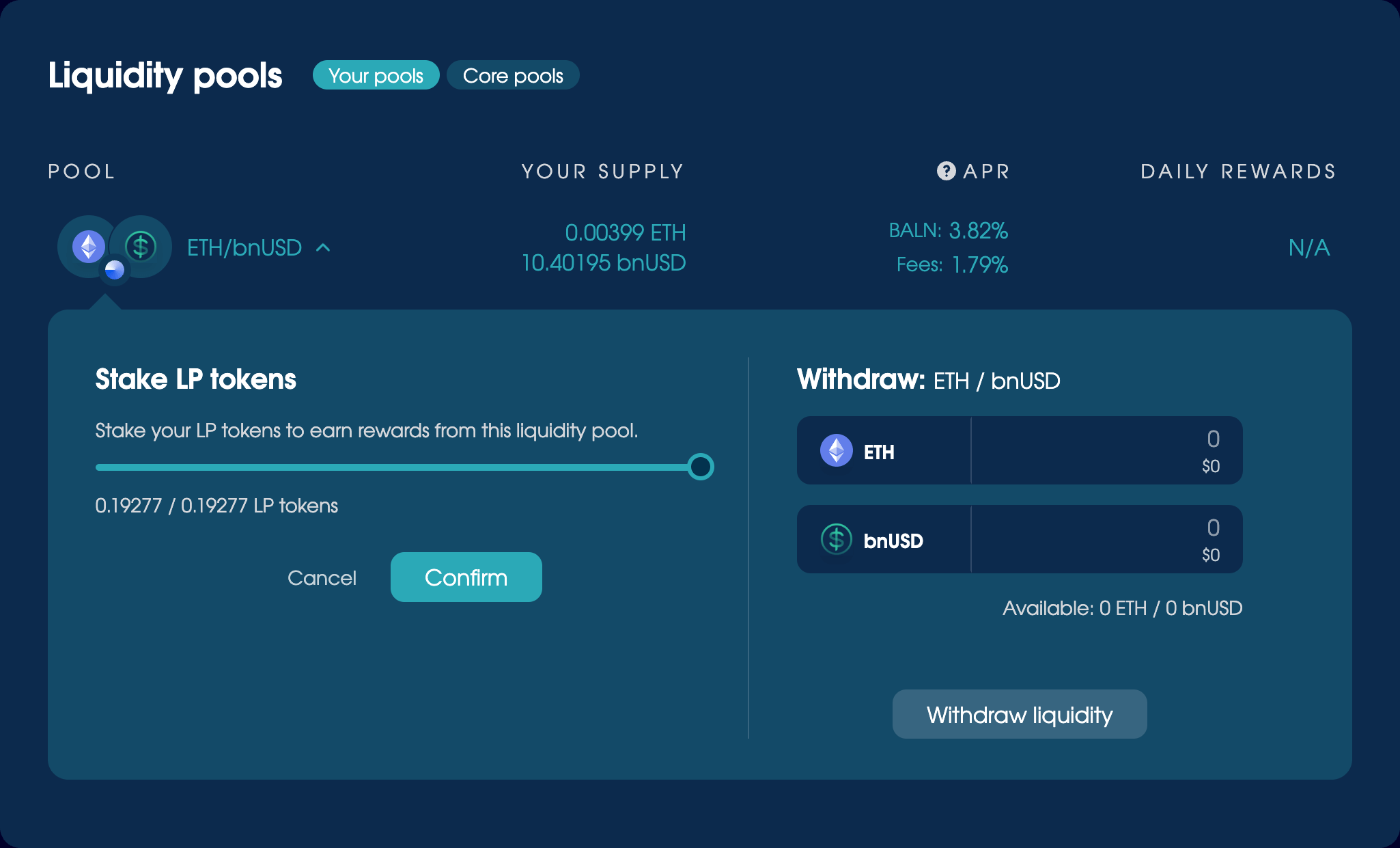

From the Supply tab on the legacy exchange:

- Choose an asset and the chain to supply on.

- Pair it with bnUSD or sICX.

- Enter an equal value of both assets, or create a new pool to set your own price ratio.

- Click Supply or ‘Create pool’, then follow the prompts to complete the transaction.

To earn liquidity incentives, stake your LP Tokens:

- Click to expand the pool in the Liquidity Pools section.

- Click ‘Adjust stake’ and set the amount.

- Confirm the transaction.

You’ll earn until you unstake them, and can’t withdraw your liquidity until you do. Claim your rewards from the Home page, but be aware that only the ICX/sICX pool continues to offer incentives.

Manage your crypto.

You can use Balanced to earn rewards for your crypto and monitor your balance across connected chains.

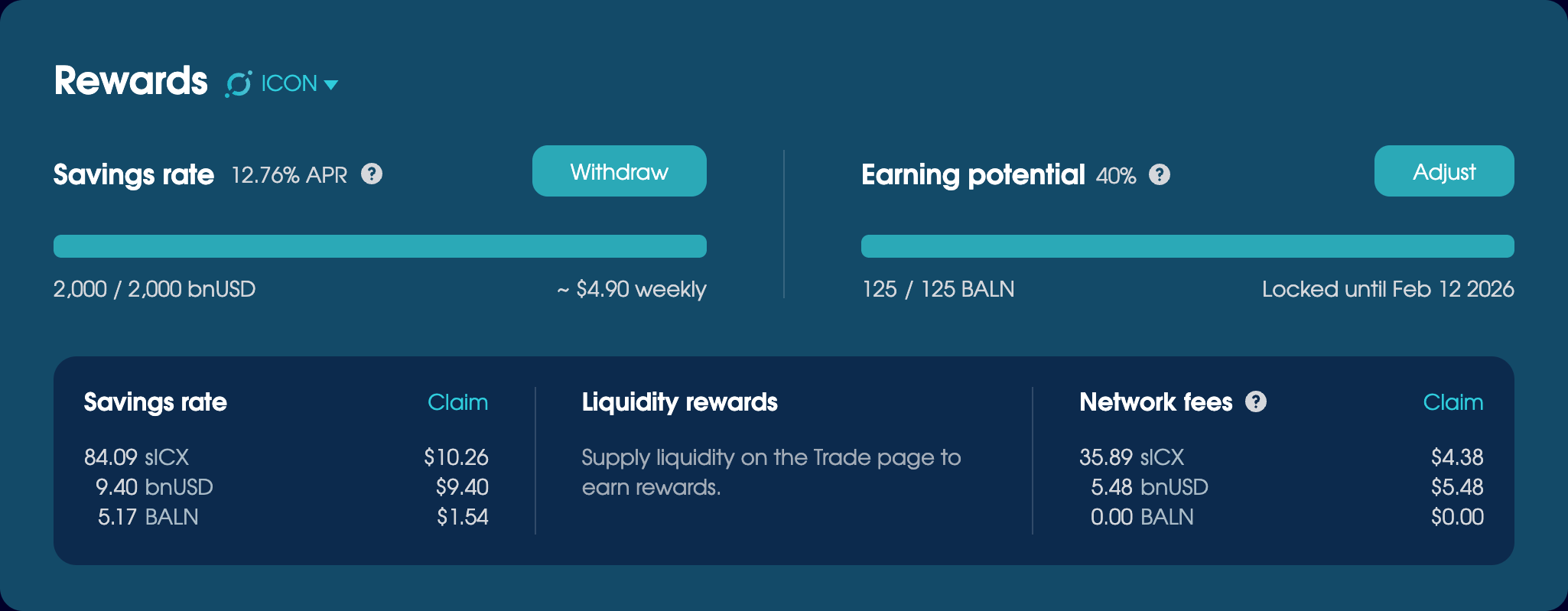

Earn and claim rewards

Earn a return on 11 chains with the Savings Rate and liquidity pools. Rewards accrue in real time, so you can claim them from the Home page whenever there’s a balance available. You can no longer earn network fees.

- Deposit bnUSD into the Savings Rate to earn interest.

- Supply liquidity to earn a share of the trading fees and ICX/sICX incentives.

Invest your stablecoins

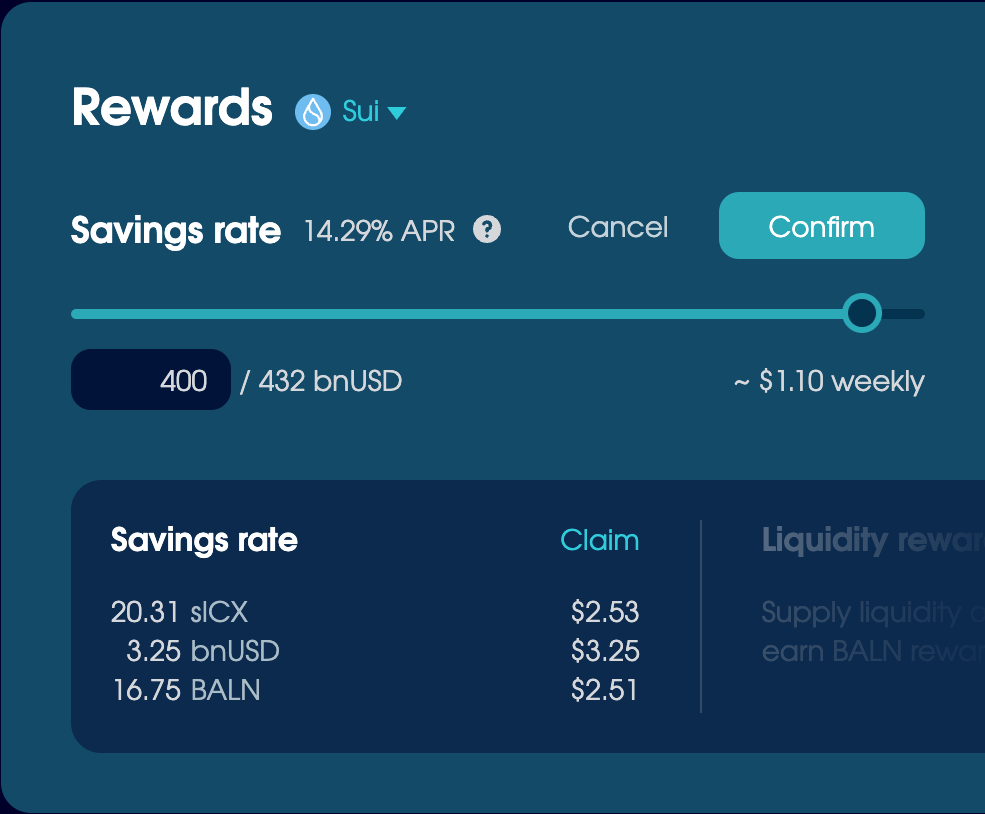

Use the Savings Rate to earn interest for bnUSD, which is paid out in sICX.

Deposit bnUSD into the Rewards > Savings Rate section on the Home page. You’ll start earning immediately and can withdraw in an instant.

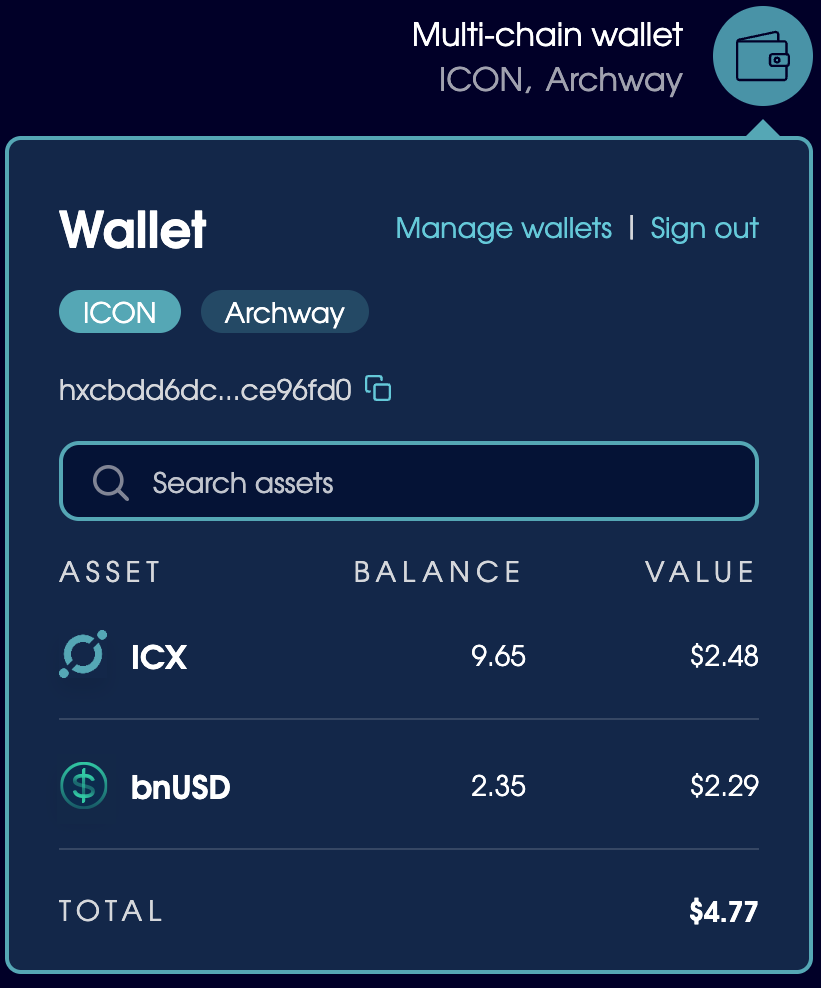

View and send assets

You can access the wallet from the top-right corner of every page. Open it to manage your connected wallets and view the assets you hold on each connected chain.

To change or disconnect a wallet, click ‘Manage wallets’.

To manage an asset held on ICON, click it. You’ll see the option to send it: just enter the amount and an address.

Participate in the Balanced DAO. Legacy

Balanced is decentralised, owned by the people who use it. Ownership comes in the form of Balance Tokens (BALN), which you can lock on the ICON blockchain to hold voting rights, boost your rewards, and benefit from Balanced’s success.

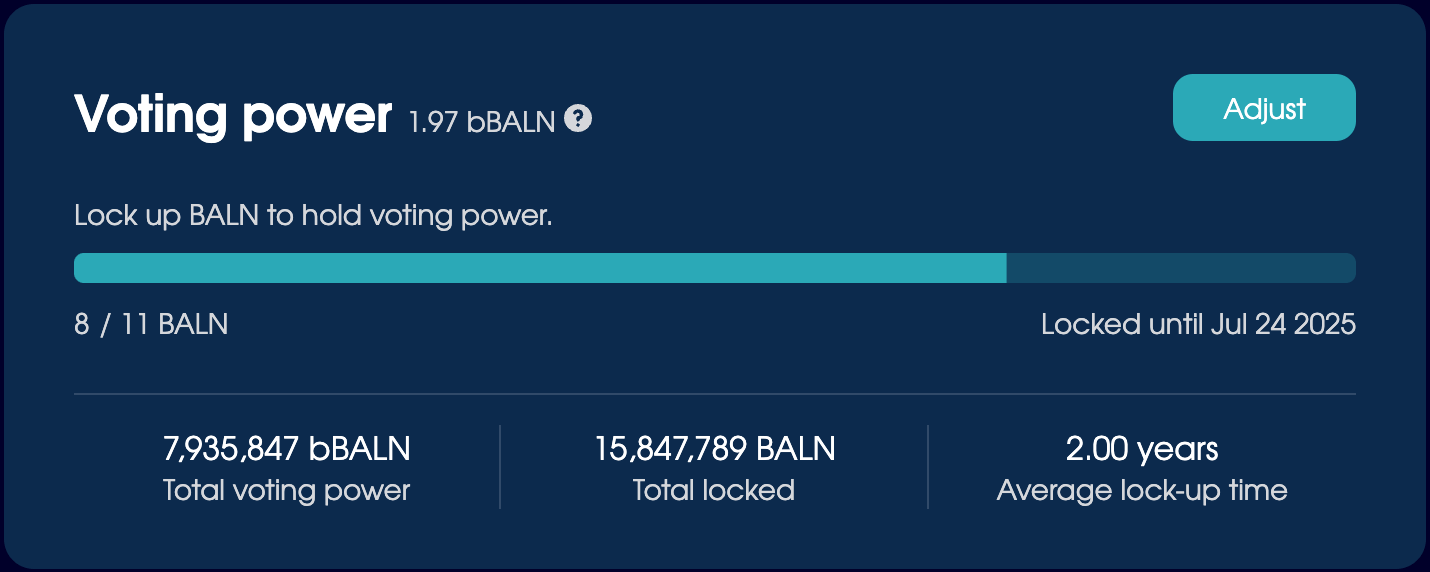

Lock up Balance Tokens

To participate in governance and increase your earning potential, lock BALN for up to 4 years. You’ll receive bBALN, a non-transferable token that holds voting power, earns network fees, and can boost your loan and liquidity rewards by up to 2.5x.

To lock up BALN from the Vote page:

- Click ‘Lock up BALN’ in the Voting Power section.

- Choose the amount of BALN to lock up and for how long.

Choose wisely: you can unlock early, but you’ll lose up to 50% as a penalty. - Click Confirm and complete the transaction.

Your bBALN holdings will decline over time, and the amount required for maximum earning potential will fluctuate. Lock up more BALN or extend the unlock date at any time.

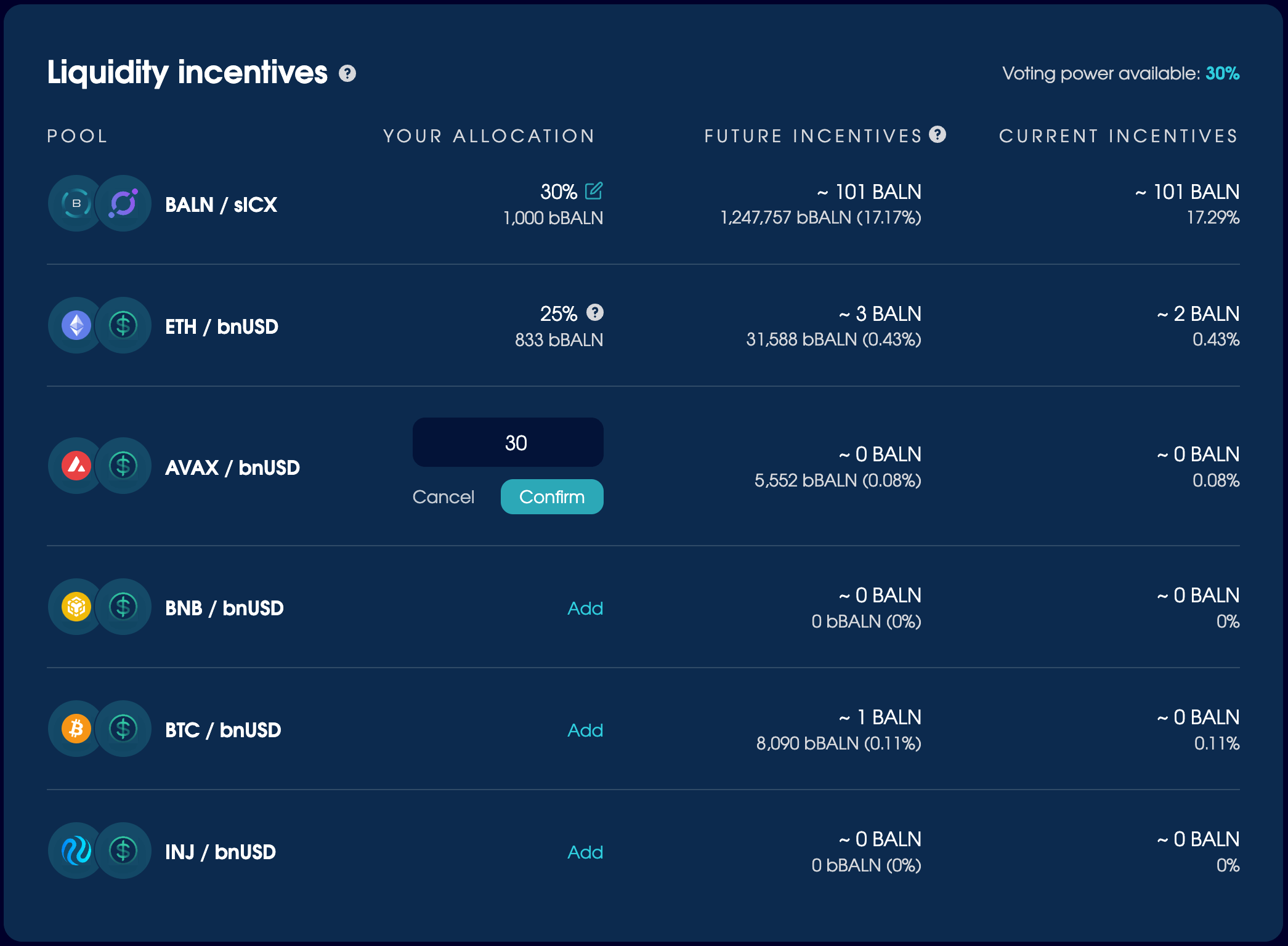

Incentivise liquidity pools

bBALN holders control the BALN reward ratio for liquidity pools. Whether you want to earn yield through bribes, boost incentives for pools you participate in, or attract more liquidity for specific pairs, your voting power will influence the assets available to trade.

To incentivise a liquidity pool:

- Go to Vote > Liquidity Incentives, then click Add for the pool you want to incentivise.

- Enter a percentage of your voting power to allocate.

Choose wisely: you won’t be able to change it for 10 days. - Click Confirm and complete the transaction.

If you vote for pools that offer bribes, make sure to claim them from the Liquidity Bribes section every week.

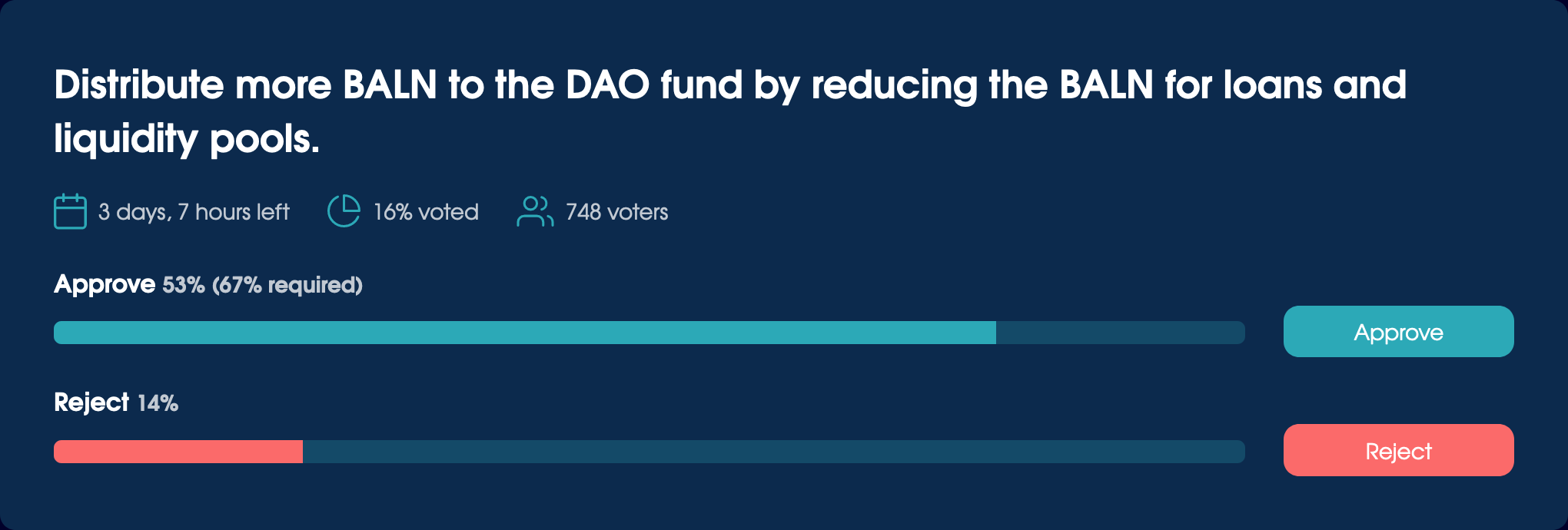

Vote on governance proposals

Shape Balanced’s future using its extensive governance functionality. You can view and discuss proposal ideas on the Balanced forum, and vote to approve or reject proposals on-chain from the Vote page.

The voting window ranges from 1 to 14 days, and your voting weight reflects the bBALN you held when the vote began. In order to pass, a proposal requires at least 30% participation and 67% approval.