bnUSD: a stablecoin backed by crypto

Use crypto as collateral to mint Balanced Dollars, a decentralised cross-chain stablecoin.

Borrow Balanced Dollars

Leverage your cryptocurrency as collateral to mint bnUSD on any supported chain.

Stabilise the price

Trade bnUSD 1:1 with other stablecoins to adjust the total supply when the price fluctuates.

Transact with confidence

Make bnUSD your main currency for payments and trades, or use it to increase your passive income.

What is the

Balanced Dollar?

The Balanced Dollar (bnUSD) is a stablecoin that tracks the price of 1 US Dollar. It uses crypto and tokenised assets (e.g. US Treasury bills) to guarantee its value, with support for a growing range of collateral types.

You can use bnUSD wrapper-free on every chain Balanced connects to. It’s over-collateralised, so the total supply cannot exceed the value that backs it.

Total supply

...

...

Total backing

...

Collateral

...

Stability Fund

...

Available on

Arbitrum

Archway

Avalanche

Base

BNB Chain

Havah

ICON

Injective

Optimism

Polygon

Solana

Stellar

Sui

Supported collateral types

afSUI

AVAX

BNB

BTCB

cbBTC

ETH

haSUI

ICX

INJ

JitoSOL

mSUI

SOL

SUI

tBTC

vSUI

wBTC

weETH

wstETH

XLM

How bnUSD

maintains its value.

The Balanced Dollar is backed by volatile cryptoassets, so how does Balanced guarantee its value?

Loans are liquidated when bnUSD is worth more than ... of the collateral that backs it. Traders can use the Stability Fund and Redemption method to reverse short-term price fluctuations. And the Savings Rate increases demand for bnUSD to attract more liquidity for the Stability Fund.

Stability Fund

The Stability Fund is the primary stability method for bnUSD, and holds most of Balanced’s stablecoin liquidity. It swaps approved stablecoins 1:1 for bnUSD, and offers the reverse for a ... fee. The Stability Fund works behind the scenes for stablecoin swaps on the Trade page.

When the Stability Fund receives stablecoins, it holds them as collateral and mints bnUSD. When the bnUSD is returned, it gets burned. There’s a maximum limit for each stablecoin, which can be changed via governance at any time.

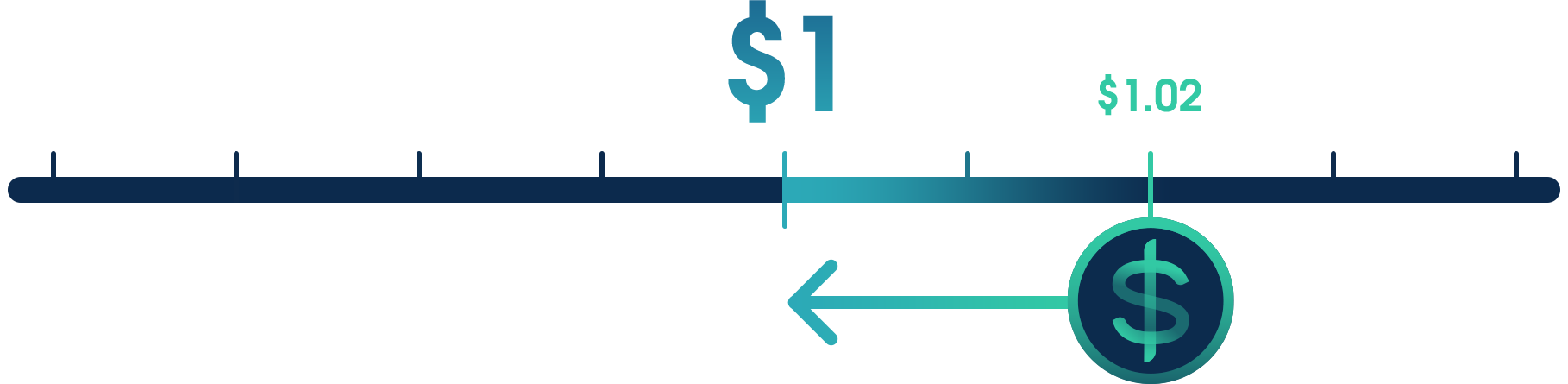

If bnUSD is above $1

Swap an approved stablecoin to mint bnUSD 1:1. Sell the bnUSD at a premium and repeat until no longer profitable.

If bnUSD is below $1

Swap bnUSD for an approved stablecoin to burn it. Buy bnUSD at a discount and repeat until no longer profitable.

Savings Rate

The Balanced Savings Rate exists to increase bnUSD demand and attract more stablecoin liquidity for the Stability Fund. Incentives come from bnUSD loan interest, 10% of the daily BALN emissions, and sICX provided by the ICON blockchain.

Learn more about the Balanced Savings Rate.Total deposited

...

Reward rate

...

Rewards distributed

...

Redemption method

The Redemption method allows traders to redeem (burn) bnUSD for borrower collateral, minus a ... fee. It’s only beneficial to redeem bnUSD if the price falls below ..., so it’s used as a last resort if the Stability Fund is empty.

Redemptions are spread across a group of borrowers to limit the impact, and are only available via smart contract.

If bnUSD is below ...

Send bnUSD to the Balanced Loans contract in exchange for ... of the value in a specific collateral type. ... of the bnUSD will be burned to repay borrowers’ debt, and ... will be sent to the DAO Fund.

What can you do with bnUSD?

Open a stablecoin loan

on your favourite blockchain.

With a few clicks, you can deposit your crypto as collateral and borrow up to ... of the value in bnUSD. There’s a ... fee, and your debt will increase by ... per year.

Earn a return from the

Balanced Savings Rate.

If you have bnUSD sitting idle in your wallet, deposit it into the Savings Rate. You’ll earn rewards in the form of BALN, bnUSD, and sICX, and you can withdraw your bnUSD at any time.

Take advantage of

arbitrage opportunities.

You can always borrow bnUSD for $1, so you can use price fluctuations to your advantage. If bnUSD trades above $1, swap it for stablecoins or other assets at a discount.

Get paid to supply liquidity.

Balanced incentivises people to supply liquidity for its exchange. If you supply bnUSD to an incentivised pool, you’ll earn BALN and a share of the trading fees.

Mint a crypto-backed stablecoin.

Borrow Balanced Dollars

Deposit collateral on the Home page, then borrow bnUSD and get it sent to the blockchain of your choice.

Use the Stability Fund

Swap approved stablecoins 1:1 for bnUSD on the Trade page. More stablecoins in = more bnUSD in circulation.