How to use

the Balanced app

Learn how to borrow bnUSD, swap and supply crypto, transfer between blockchains, lock up BALN, participate in governance, and more.

Sign in to the Balanced app with a compatible browser wallet, or access it through the Hana wallet on iOS and Android.

Borrow Balanced Dollars.

The Balanced Dollar (bnUSD) is a decentralised stablecoin that tracks the price of 1 US dollar. You can borrow bnUSD against any supported collateral type, and use it wrapper-free on every blockchain Balanced connects to. There’s a ... fee, and your loan will increase by ... a year.

Learn more about the Balanced stablecoin.

1. Deposit collateral

You can deposit a variety of assets as collateral. Each collateral type represents a separate position with its own risk profile.

From the Collateral section on the Home page:

- Choose a collateral type and blockchain to use.

- Click Deposit and enter the amount.

- Check the Loan section to see how many bnUSD you can borrow.

- Click Confirm and complete the transaction.

The same asset on multiple blockchains = multiple positions. If you deposit ETH on Arbitrum and Base, you have two positions, so you can borrow against your Arbitrum ETH without putting your Base ETH at risk.

2. Take out a loan

Borrow bnUSD against your collateral, which you can receive and repay from any supported blockchain.

Make sure the correct collateral type is active, then, from the Loan section:

- Choose which blockchain to use.

- Click Borrow and enter the amount.

- Use the Position Details section to assess your risk.

- Click Confirm and complete the transaction.

A loan puts your collateral at risk.

Your risk increases when the USD value of your collateral drops. If it ever falls below ... of your loan (... loan-to-value ratio), it will be partially liquidated to reduce your risk.

Keep an eye on your risk from the Position Details section.

3. Monitor your position

Use the Position Details section to monitor your risk and adjust each loan position. It includes the price your collateral type needs to reach to trigger liquidation, so you can assess your risk against the market.

To lower your risk ratio, reduce your loan or deposit more collateral.

Use the decentralised exchange.

Balanced includes a decentralised exchange so you can swap crypto, supply liquidity, and transfer value across chains.

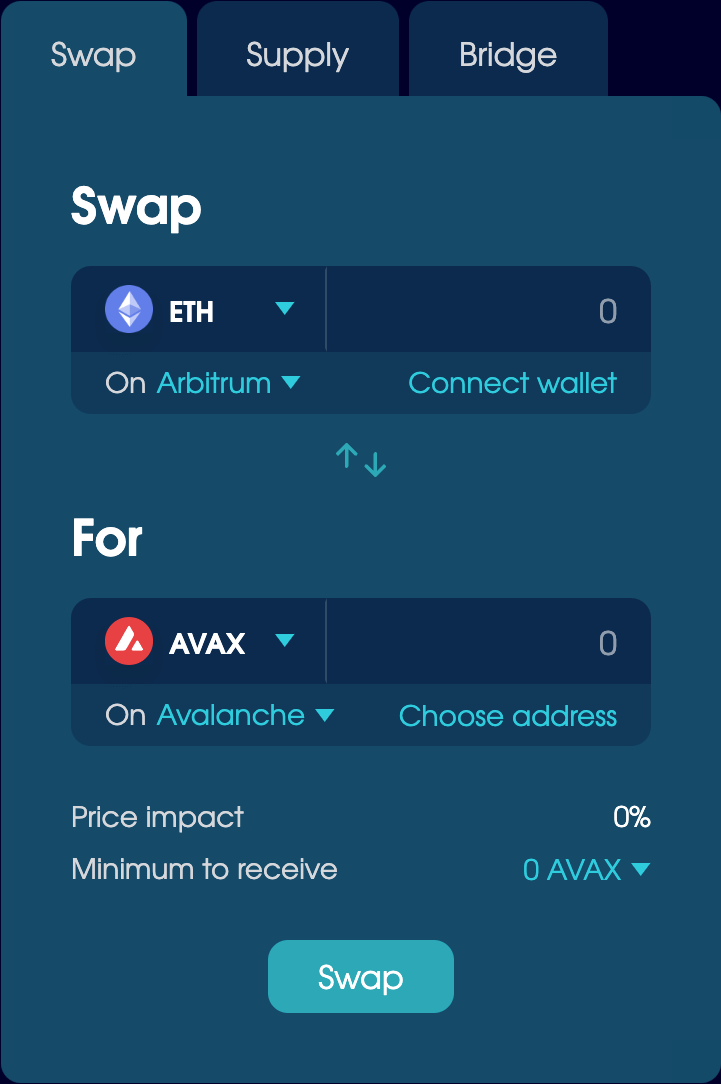

Swap assets

You can trade your crypto for a range of assets, and move value between blockchains in 60 seconds or less.

From the Swap tab on the Trade page:

- Choose which assets to swap and receive.

- Choose which blockchains you’d like to send and receive on.

- Enter the amount to swap, then adjust the slippage tolerance and recipient address if necessary.

- Click Swap and complete the transaction.

You can view pending cross-chain transactions from the Bridge tab. If you need to confirm or revert them, you’ll see an option to do so.

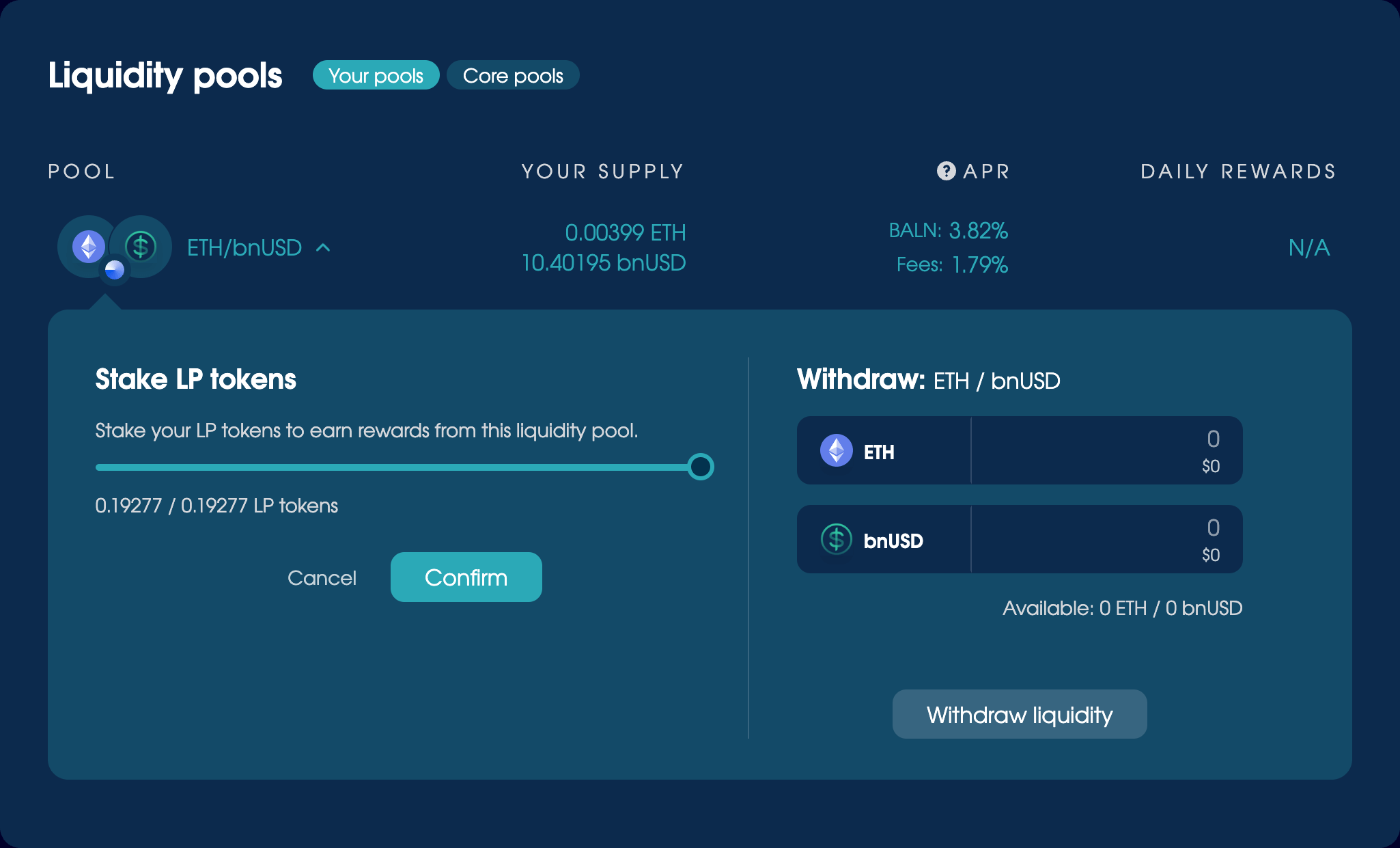

Supply liquidity.

Supply liquidity on any connected chain to improve the Balanced trading experience. Liquidity pools receive ... of the trading fees, and many offer incentives. To evaluate a specific pool, use the impermanent loss calculator.

From the Supply tab on the Trade page:

- Choose an asset and the chain to supply on.

- Pair it with bnUSD or sICX.

- Enter an equal value of both assets, or create a new pool to set your own price ratio.

- Click Supply or ‘Create pool’, then follow the prompts to complete the transaction.

To earn liquidity incentives, stake your LP Tokens:

- Click to expand the pool in the Liquidity Pools section.

- Click ‘Adjust stake’ and set the amount.

- Confirm the transaction.

You’ll earn until you unstake them, and can’t withdraw your liquidity until you do. Claim rewards on the Home page, and lock up BALN to maximise your return for liquidity on ICON.

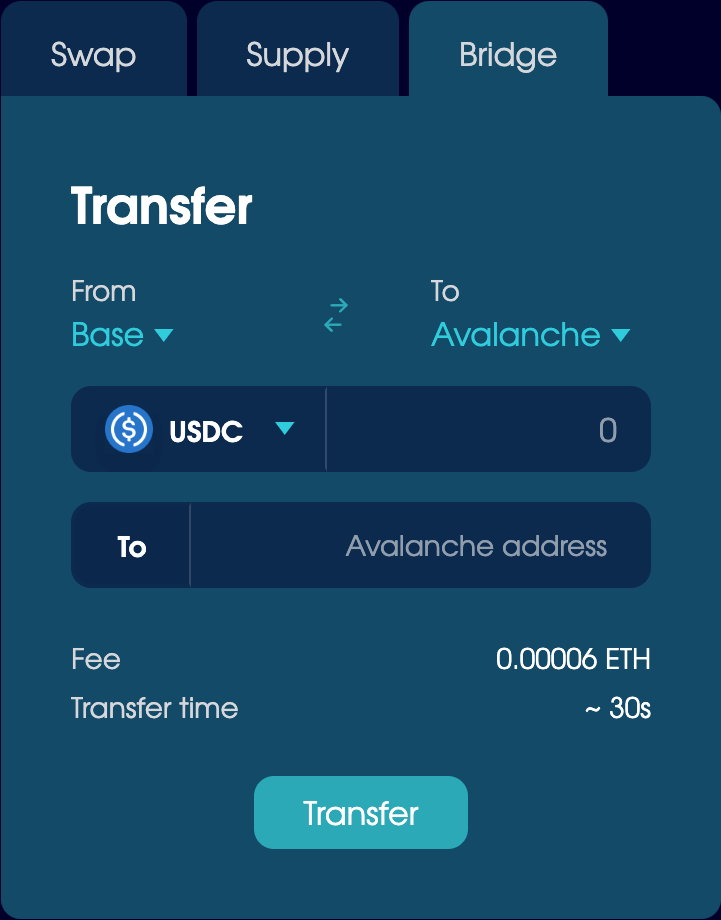

Transfer between blockchains

Balanced includes support for ICON’s cross-chain messenger, so you can transfer crypto to a wallet on another blockchain.

From the Bridge tab on the Trade page:

- Choose which blockchains to transfer between.

- Choose an asset, then enter the amount.

- Enter a compatible blockchain address.

- Click Transfer, then follow the prompts to complete the transaction.

The Bridge tab includes a list of pending cross-chain transactions. If you need to approve or revoke them, you’ll see an option to do so.

Manage your crypto.

You can use Balanced to earn rewards for your crypto and monitor your balance across connected chains.

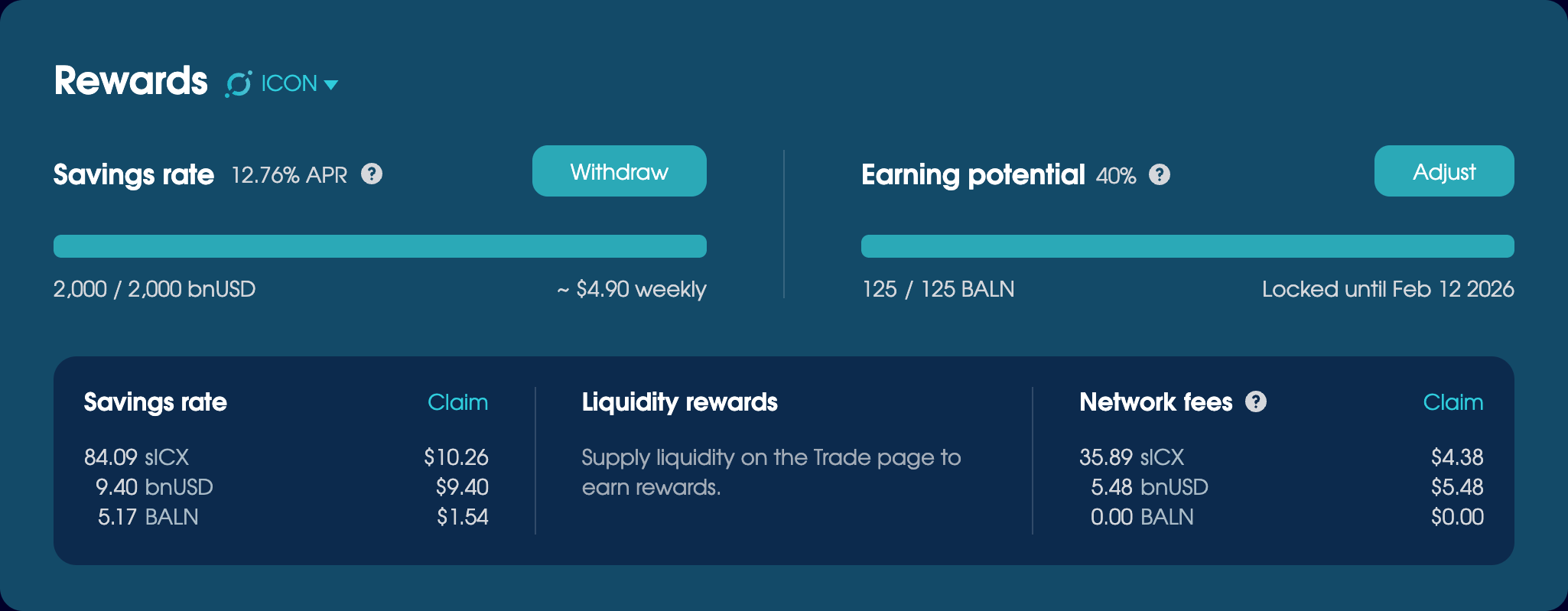

Earn and claim rewards

Earn a return on 10 chains with the Savings Rate, liquidity pools, and Balance Tokens (BALN). Rewards accrue in real time, so you can claim them from the Home page whenever there’s a balance available.

- Deposit bnUSD into the Savings Rate to earn interest.

- Supply liquidity to earn liquidity rewards.

- Lock up BALN on ICON to boost your liquidity rewards and earn a share of the network fees.

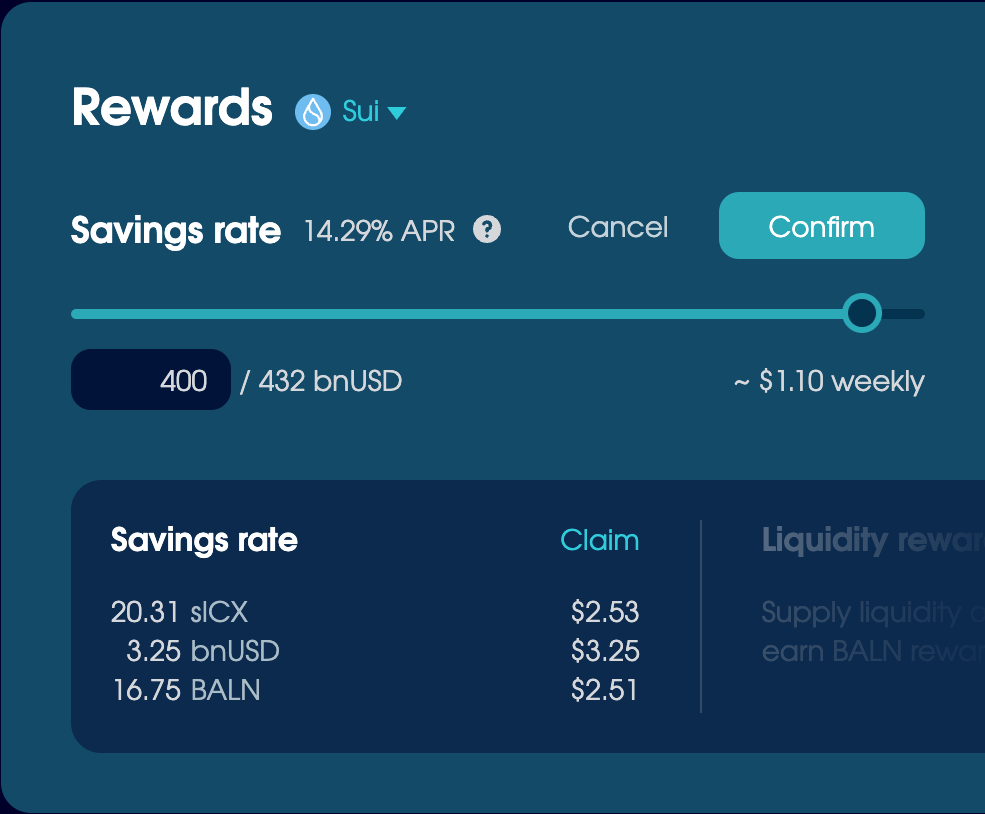

Invest your stablecoins

Use the Savings Rate to earn interest for bnUSD in the form of BALN, bnUSD, and sICX.

Deposit bnUSD into the Rewards > Savings Rate section on the Home page. You’ll start earning immediately and can withdraw in an instant.

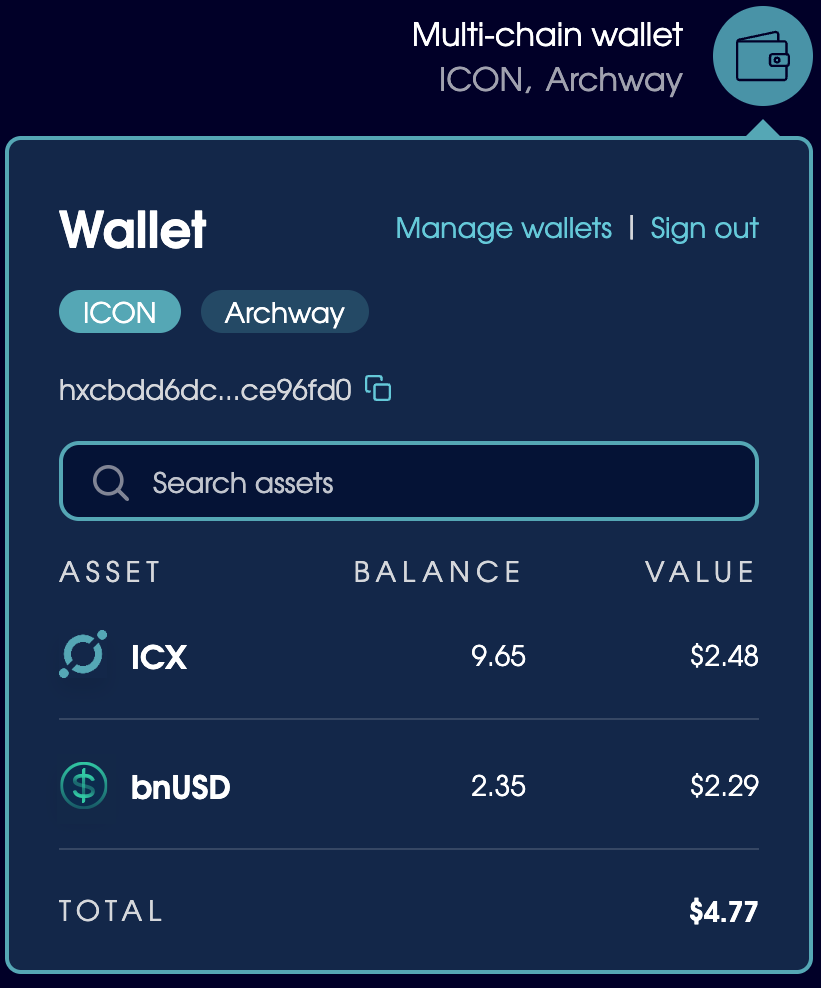

View and send assets

You can access the wallet from the top-right corner of every page. Open it to manage your connected wallets and view the assets you hold on each connected chain.

To change or disconnect a wallet, click ‘Manage wallets’.

To manage an asset held on ICON, click it. You’ll see the option to send it: just enter the amount and an address.

Participate in the Balanced DAO.

Balanced is decentralised, owned by the people who use it. Ownership comes in the form of Balance Tokens (BALN), which you can lock on the ICON blockchain to hold voting rights, boost your rewards, and benefit from Balanced’s success.

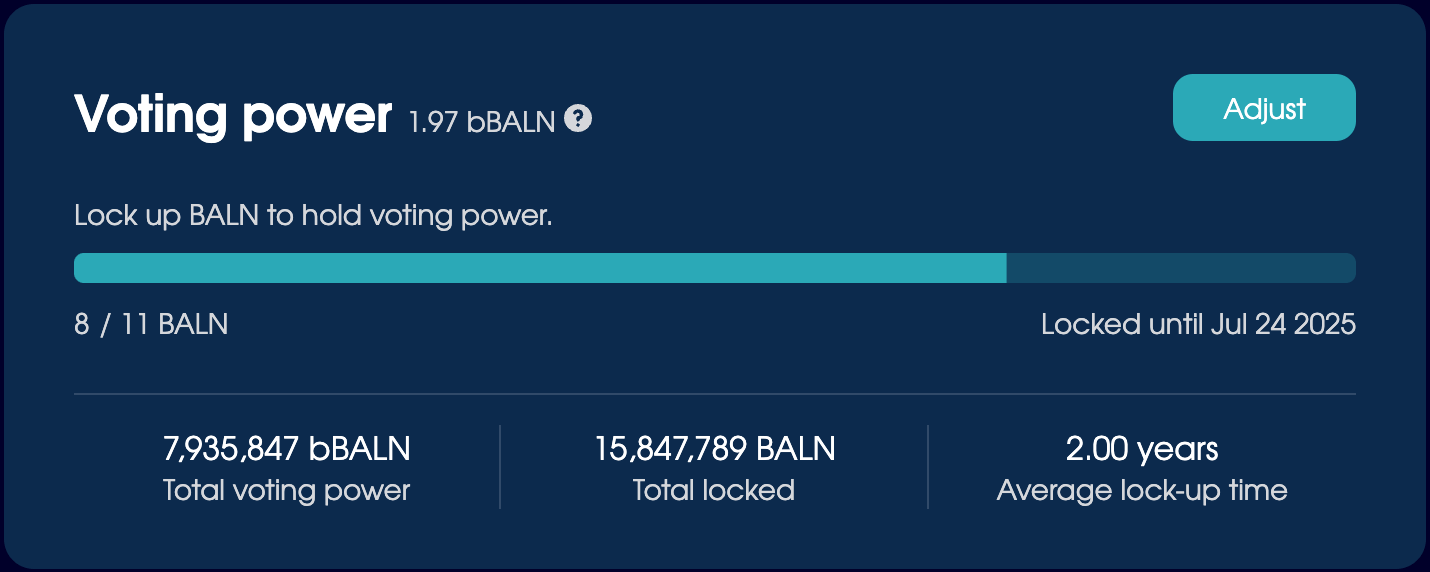

Lock up Balance Tokens

To participate in governance and increase your earning potential, lock BALN for up to 4 years. You’ll receive bBALN, a non-transferable token that holds voting power, earns network fees, and can boost your loan and liquidity rewards by up to 2.5x.

To lock up BALN from the Vote page:

- Click ‘Lock up BALN’ in the Voting Power section.

- Choose the amount of BALN to lock up and for how long.

Choose wisely: you can unlock early, but you’ll lose up to 50% as a penalty. - Click Confirm and complete the transaction.

Your bBALN holdings will decline over time, and the amount required for maximum earning potential will fluctuate. Lock up more BALN or extend the unlock date at any time.

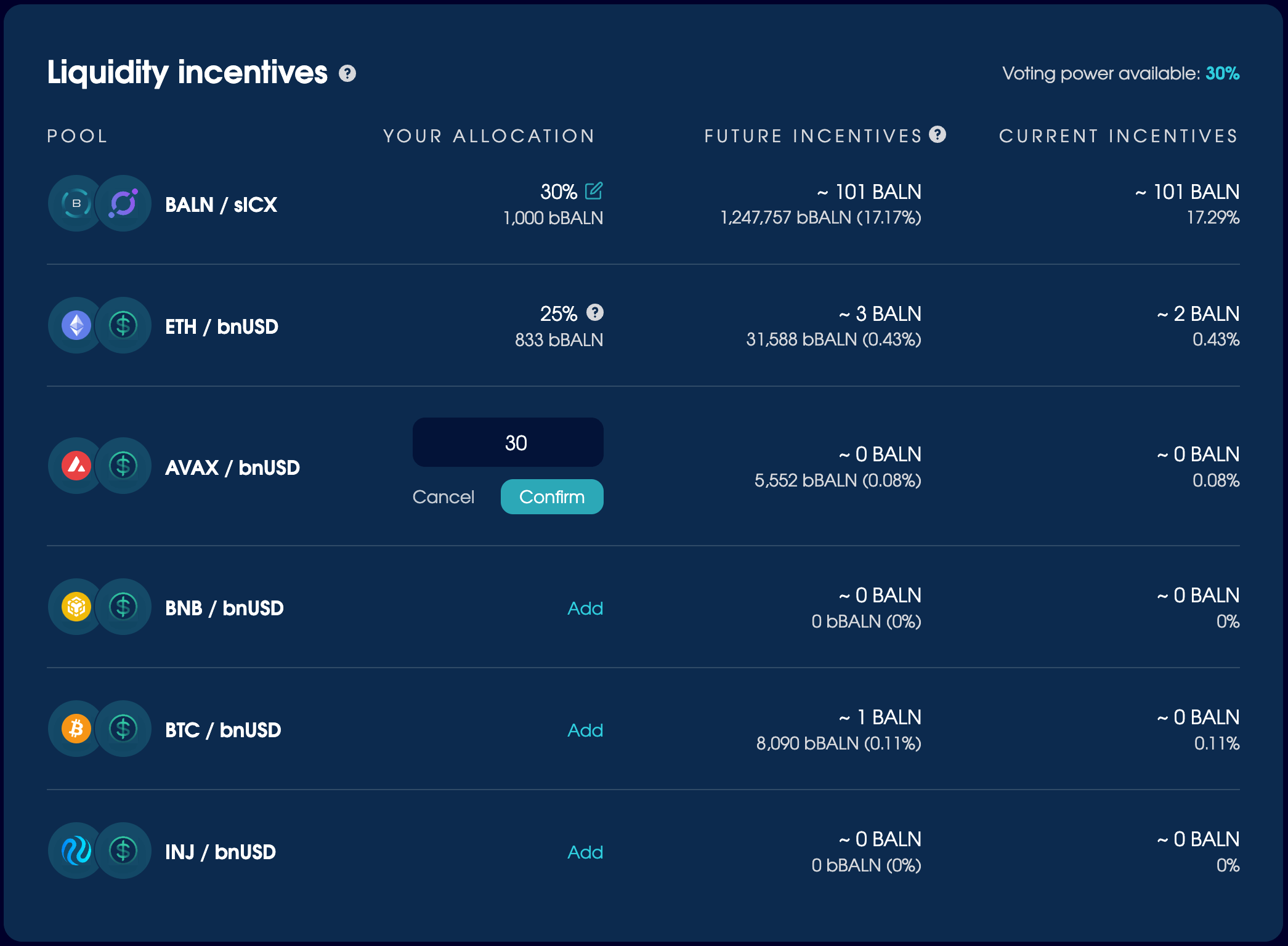

Incentivise liquidity pools

bBALN holders control the BALN reward ratio for liquidity pools. Whether you want to earn yield through bribes, boost incentives for pools you participate in, or attract more liquidity for specific pairs, your voting power will influence the assets available to trade.

To incentivise a liquidity pool:

- Go to Vote > Liquidity Incentives, then click Add for the pool you want to incentivise.

- Enter a percentage of your voting power to allocate.

Choose wisely: you won’t be able to change it for 10 days. - Click Confirm and complete the transaction.

If you vote for pools that offer bribes, make sure to claim them from the Liquidity Bribes section every week.

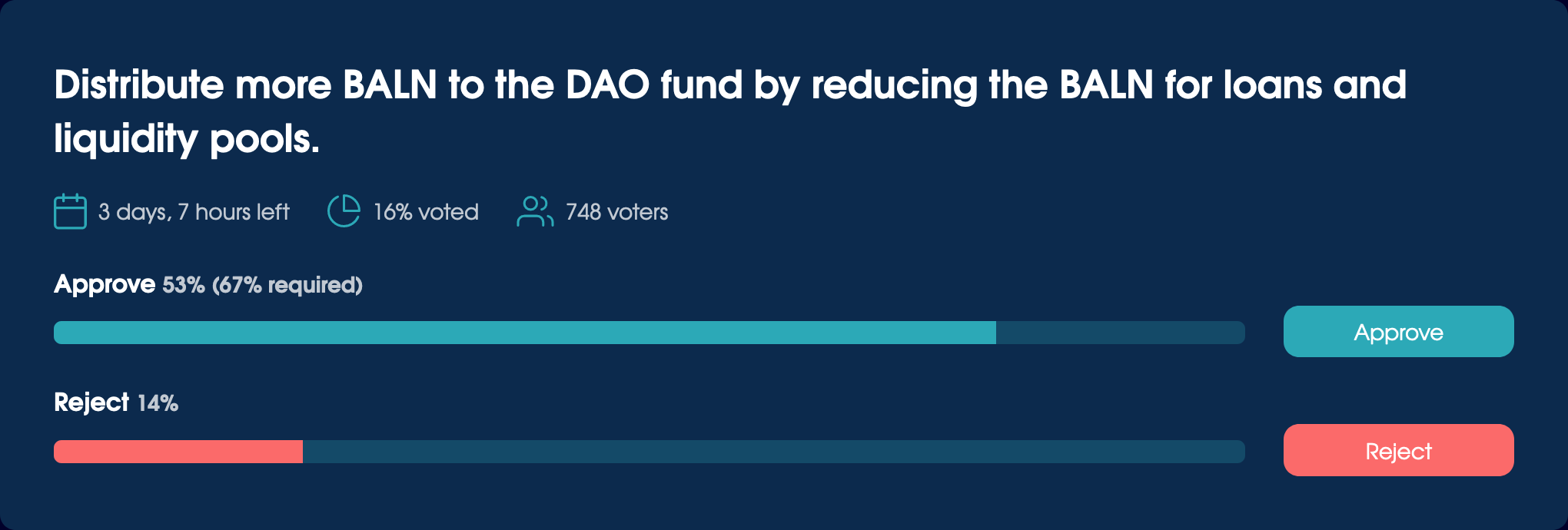

Vote on governance proposals

Shape Balanced’s future using its extensive governance functionality. You can view and discuss proposal ideas on the Balanced forum, and vote to approve or reject proposals on-chain from the Vote page.

The voting window ranges from 1 to 14 days, and your voting weight reflects the bBALN you held when the vote began. In order to pass, a proposal requires at least 30% participation and 67% approval.