Balanced timeline

From single chain to multi-chain to multi-protocol: see what Balanced has achieved and where it’s going next.

Roadmap

Planned

Widget implementation

- Phase one: Informational

- Phase two: Multi-protocol

On our radar

- Sign in with email

- Leverage trading

- Mobile app

Changelog

Hyperliquid connection

Balanced released support for Polygon, its thirteenth blockchain connection.

You can use Balanced on Hyperliquid to trade HYPE and Hyperliquid USDC with crypto on other connected chains.

A protocol no more

The DAO approved the final Balanced proposal to remove governance and stop BALN inflation. BALN holders can now migrate to SODA (the SODAX governance token), and the DAO Fund will be distributed in May 2026 based on the number of SODA people lock up during the migration.

This is the final step in Balanced’s transition from protocol to frontend-only, and it is no longer a community-owned app.

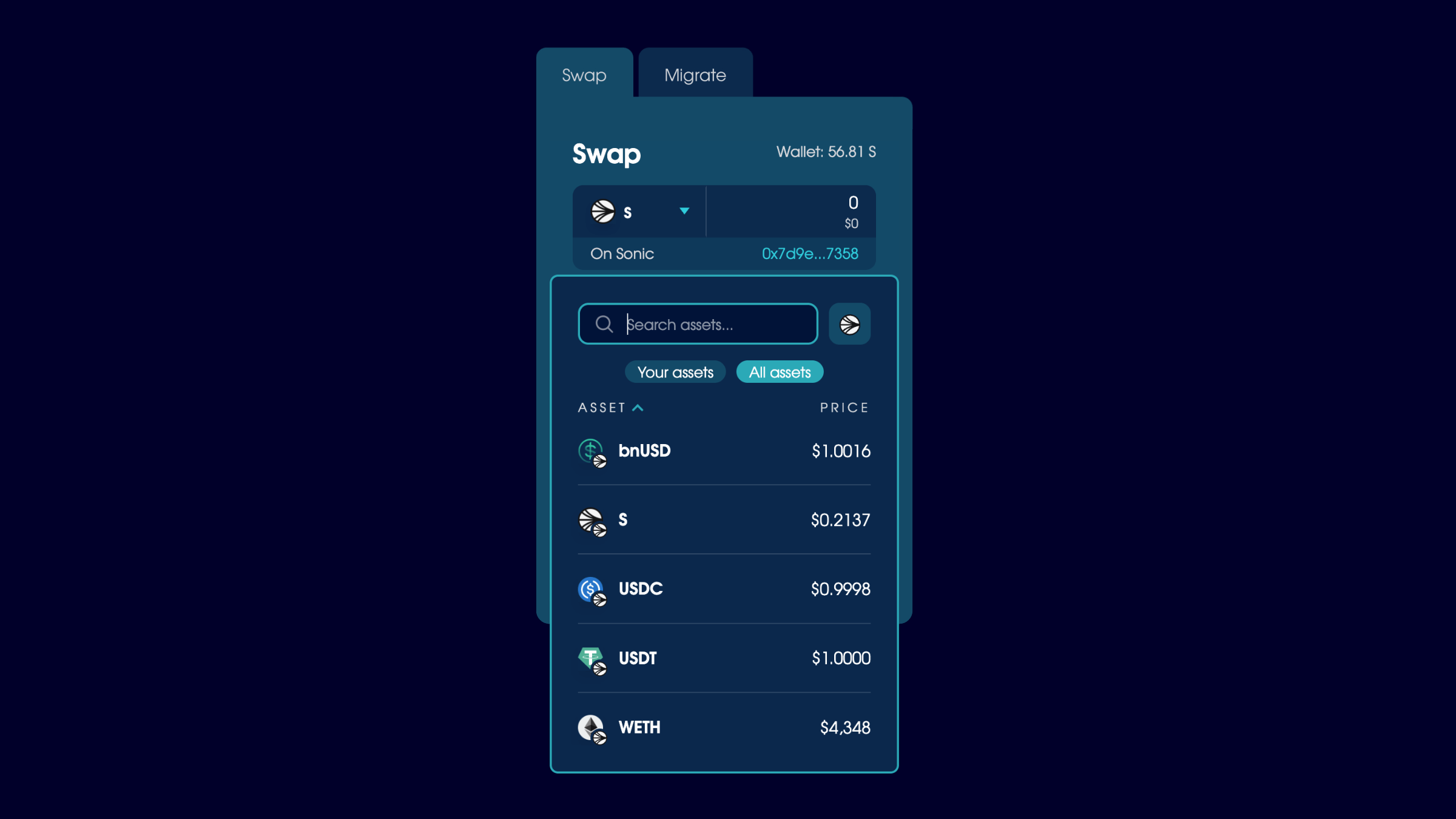

Intent-based trades on every chain, and a connection to Sonic

Balanced released support for SODAX Intents, so it could use intent-based trades for every asset on every connected chain. This update is the first step in Balanced's transition from a protocol to a frontend that uses the new SODAX infrastructure.

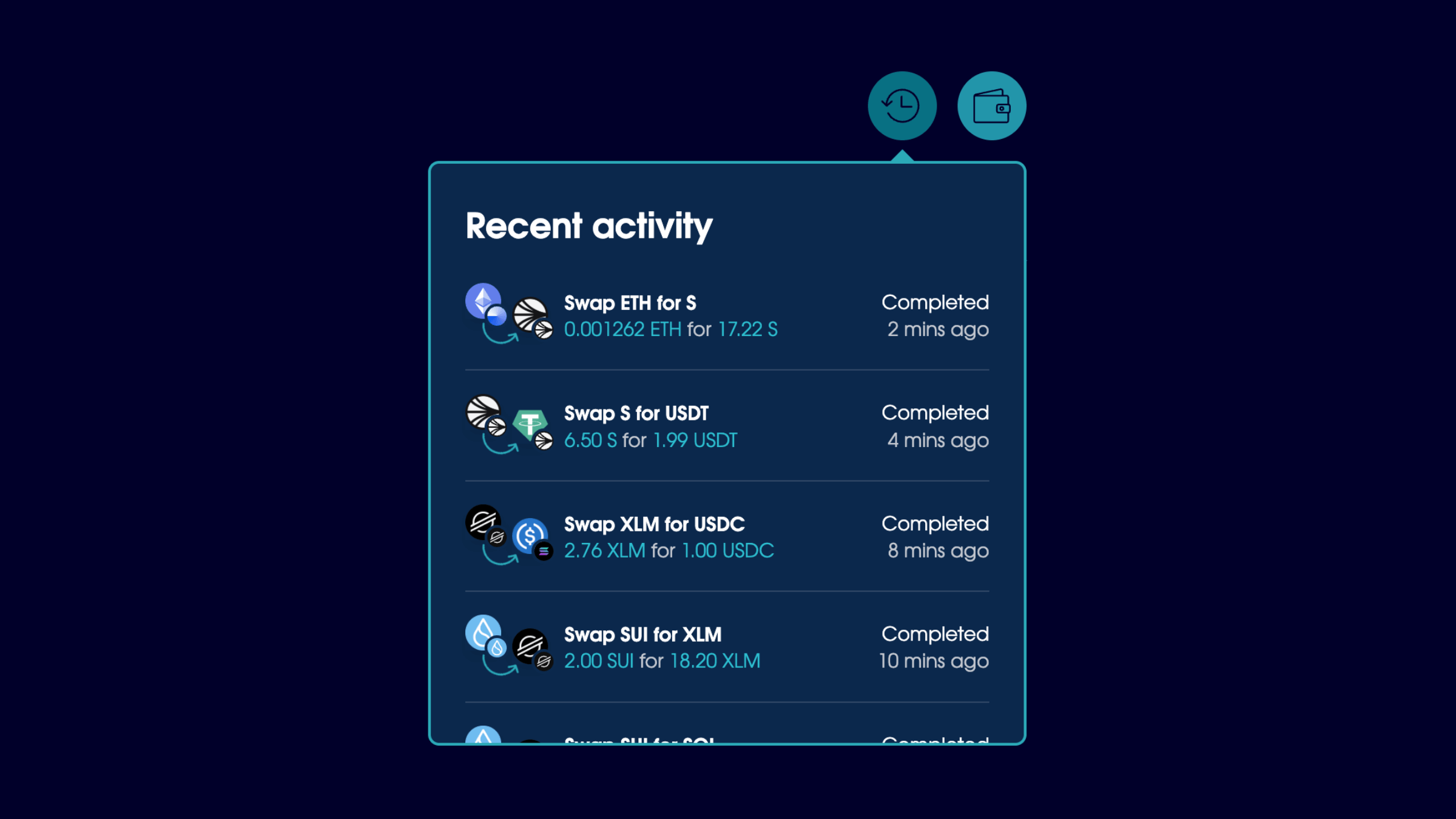

Balanced also connected to Sonic, added a Recent Activity dropdown, merged the Swap and Bridge tabs, and moved the legacy exchange to a separate page. And there's now a Migrate tab on the Trade page to handle two versions of bnUSD, an unavoidable consequence of the move to a new tech stack.

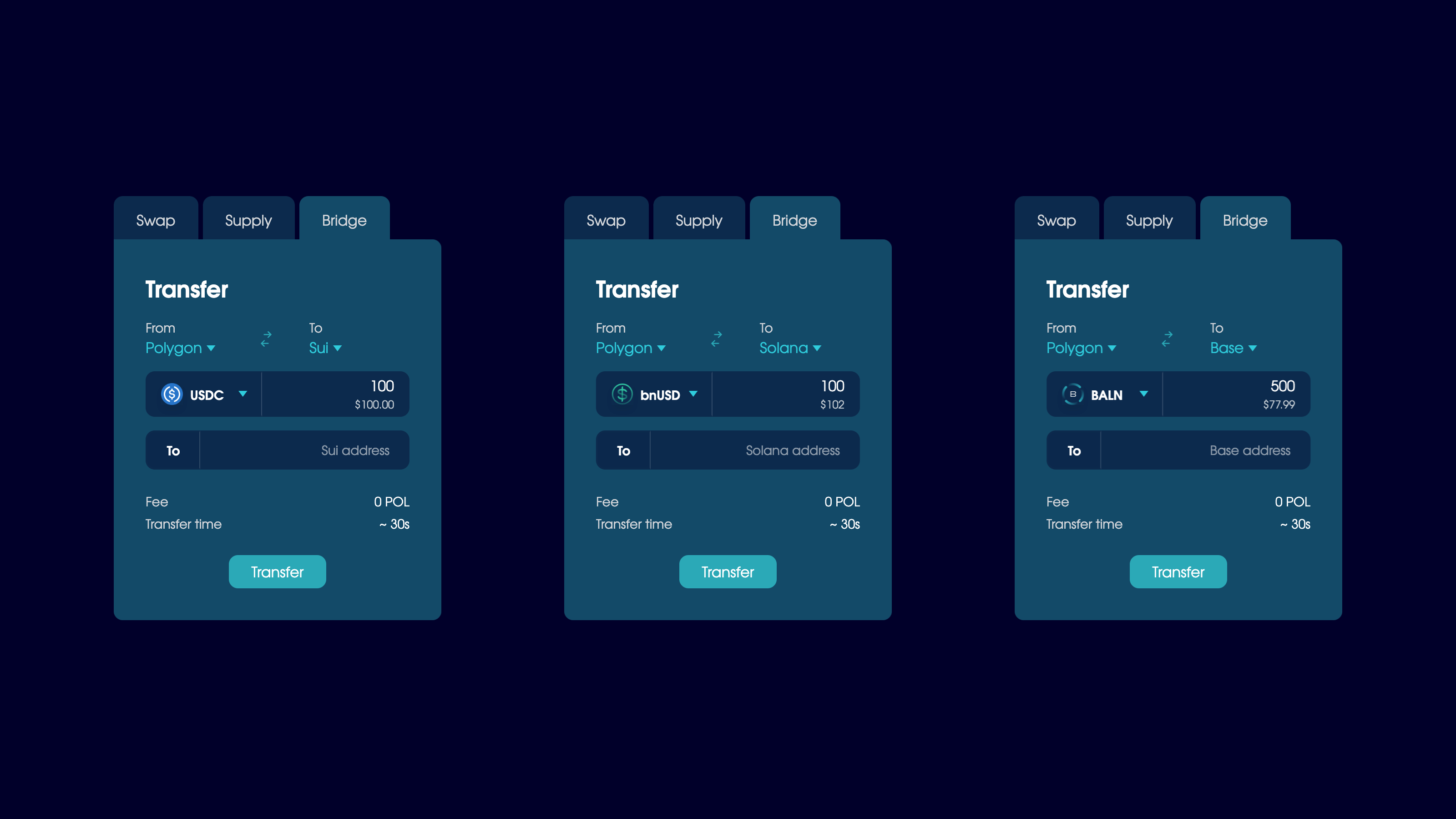

Polygon connection

Balanced released support for Polygon, its eleventh blockchain connection.

You can use Balanced on Polygon to trade and transfer crypto cross-chain with intent-based trades, and earn a return for bnUSD with the Balanced Savings Rate.

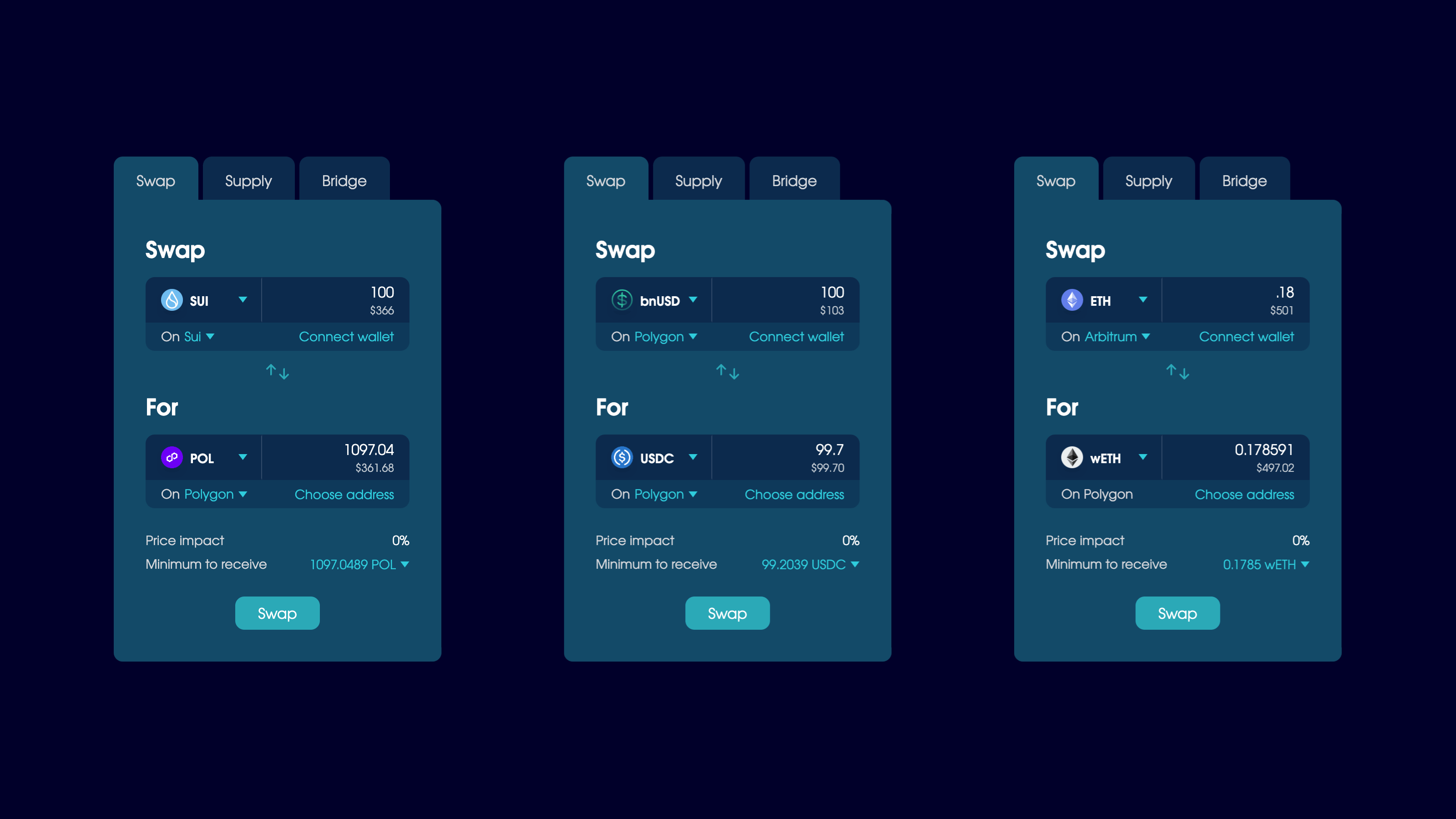

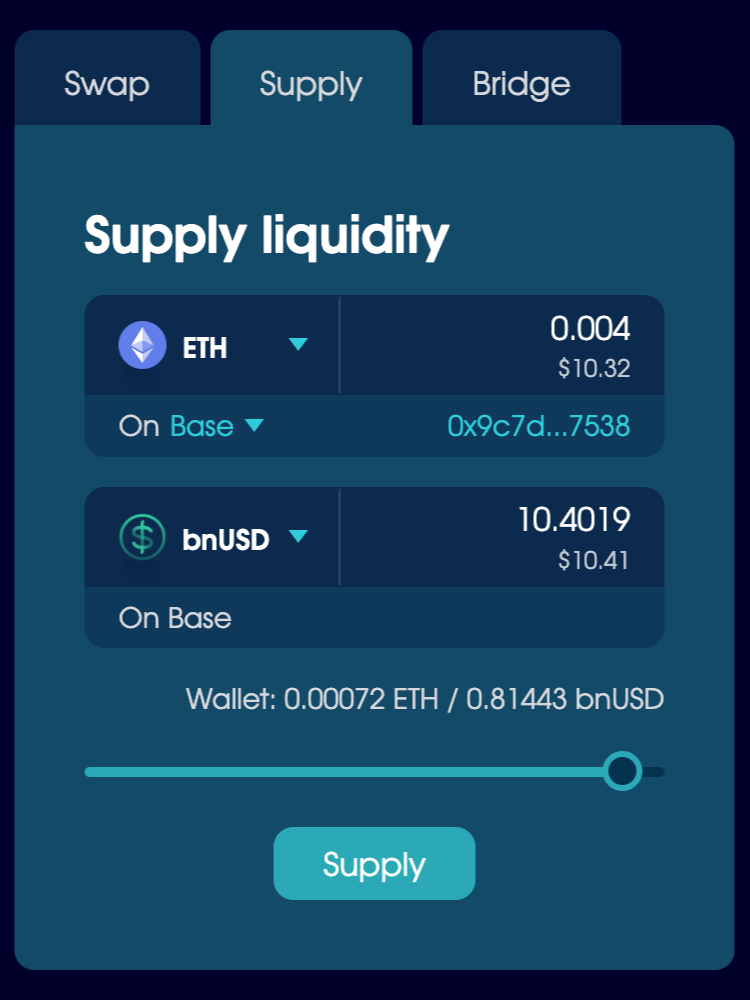

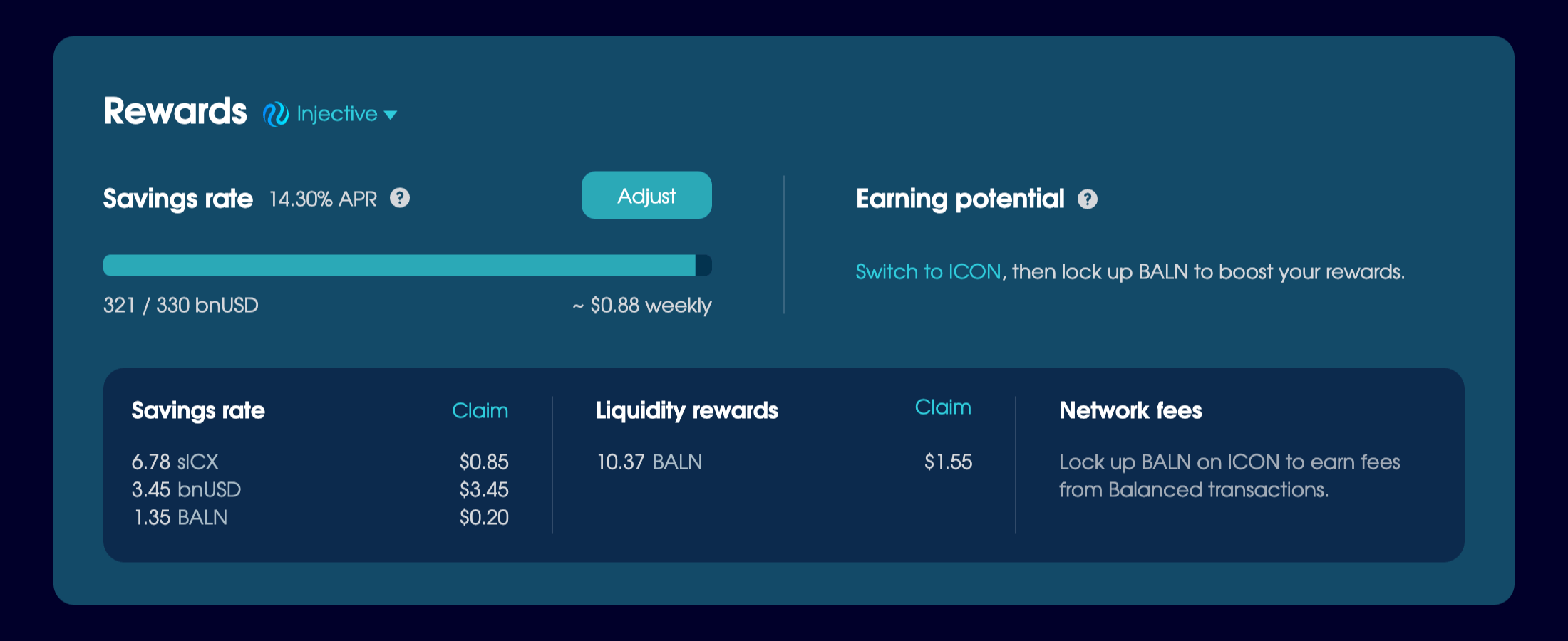

Cross-chain liquidity, Savings Rate, and rewards

Balanced began the next phase of its cross-chain journey by making the liquidity pools, Savings Rate, and rewards available on 10 blockchains. After this release, governance was the only feature limited to a single chain (ICON).

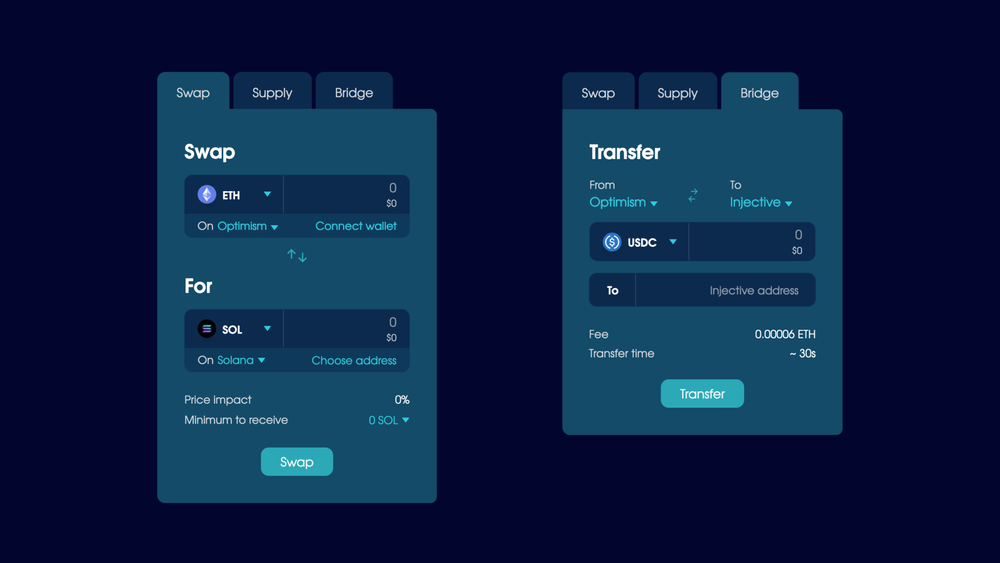

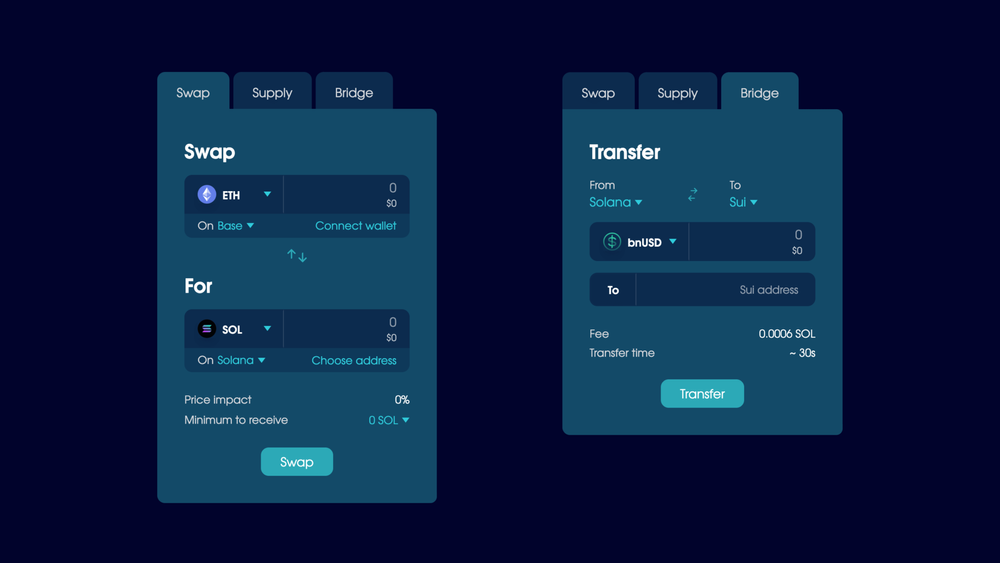

Intent-based trades

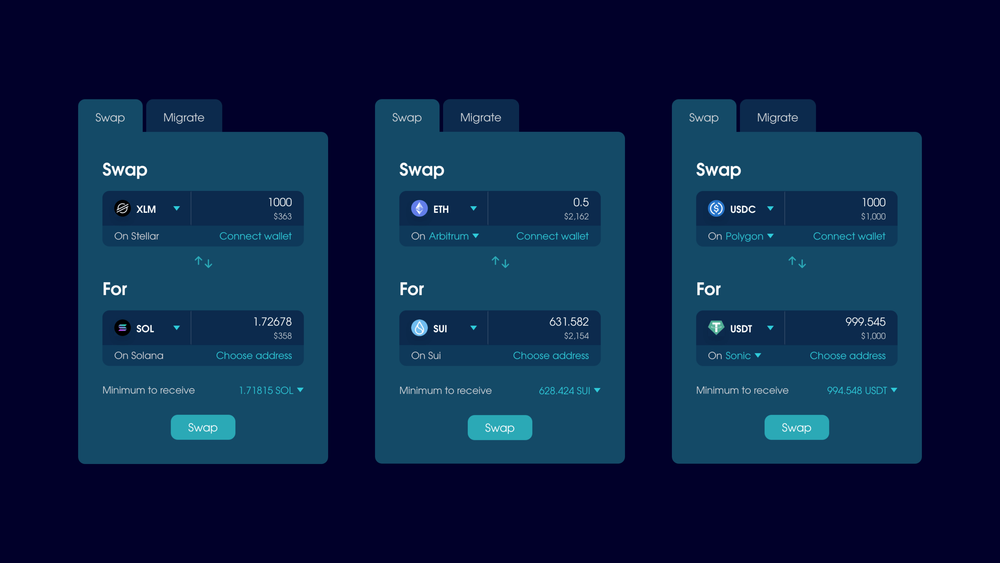

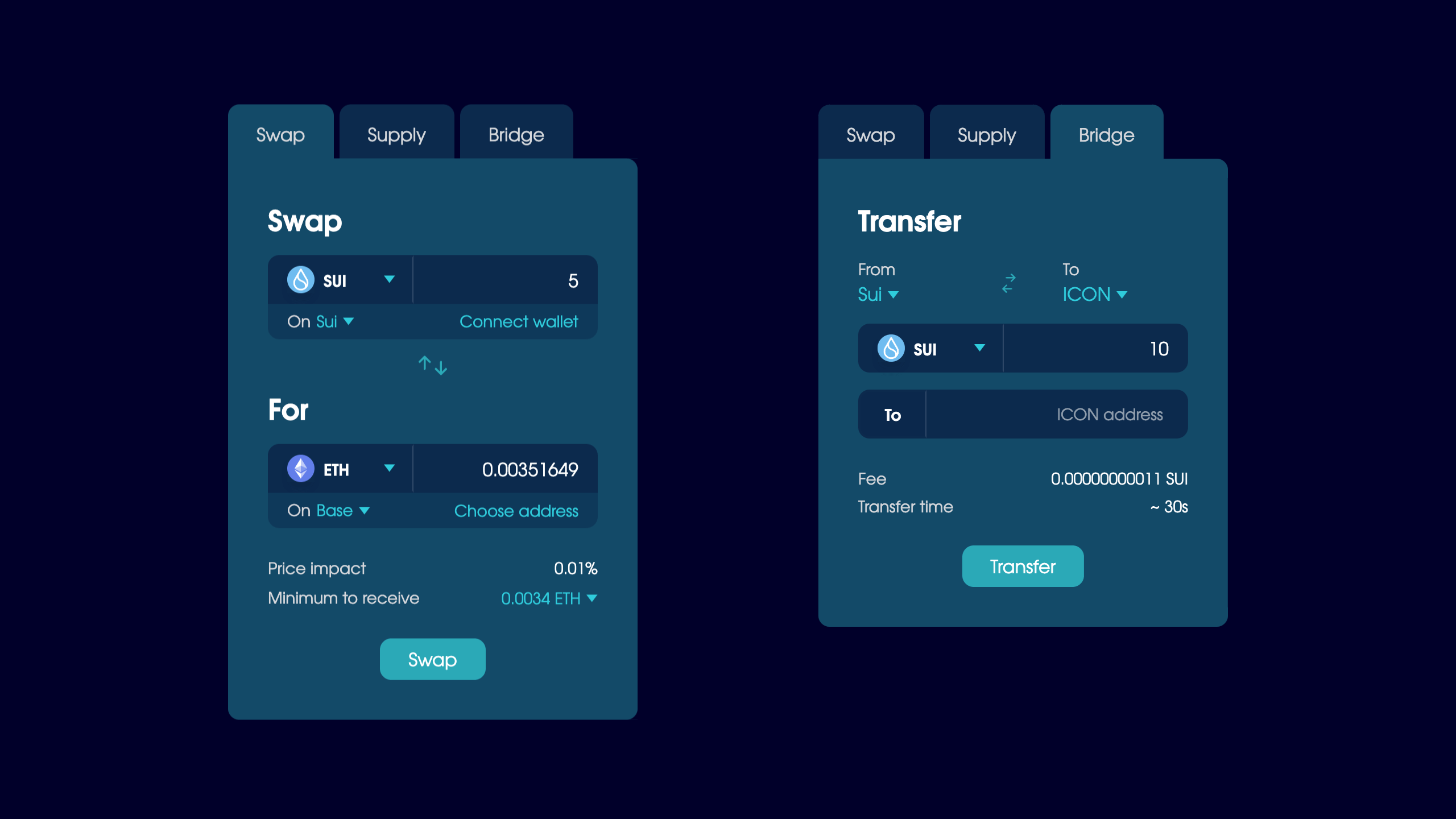

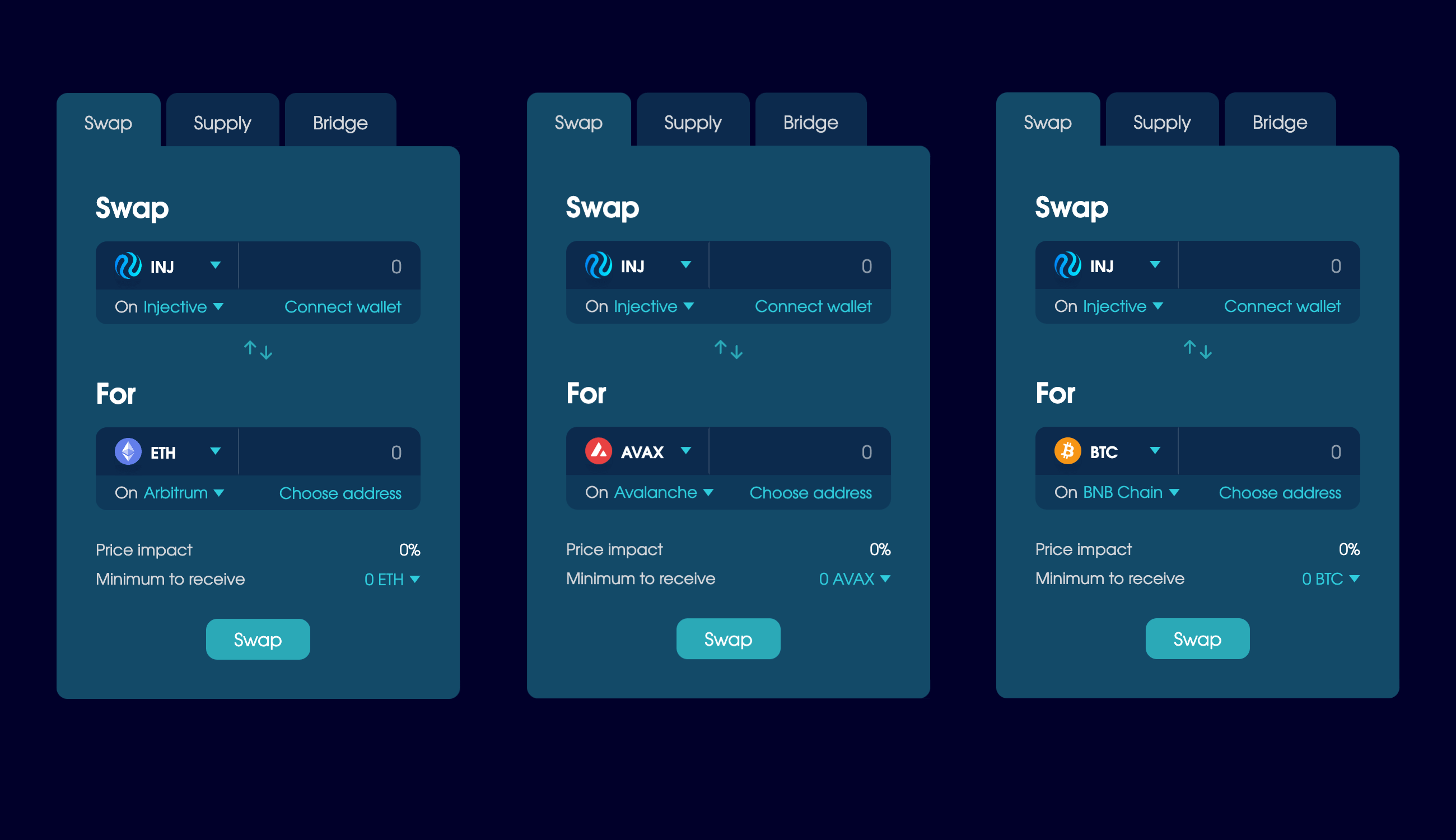

Balanced released support for intent-based trades between Sui and Arbitrum, so you can swap ETH and SUI across chains with in ~5 seconds with low fees and zero slippage.

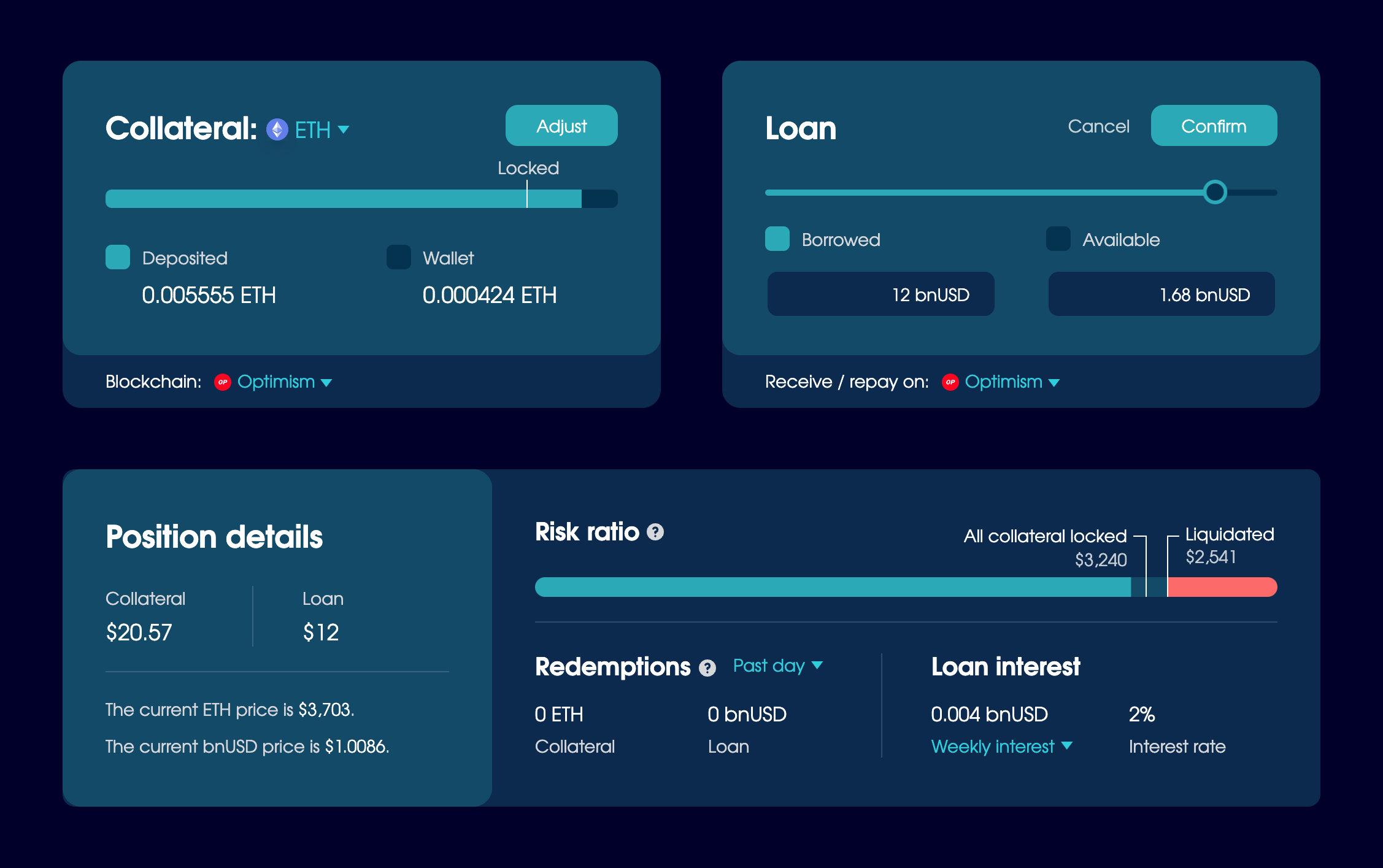

Optimism connection

Balanced released support for Optimism, its tenth blockchain connection.

You can use Balanced on Optimism to trade, transfer crypto cross-chain, and borrow bnUSD against ETH.

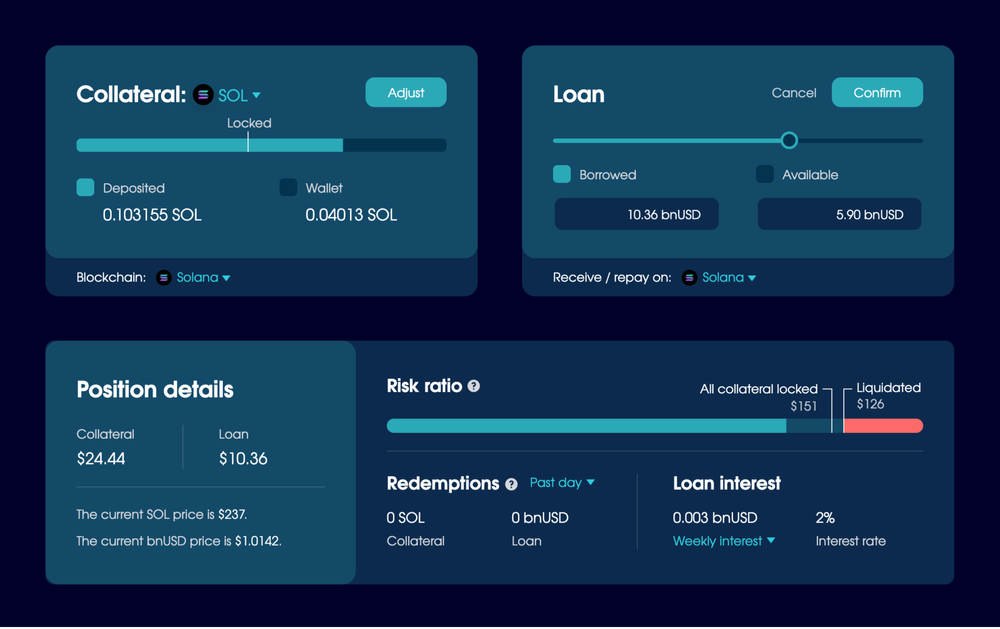

Solana connection

Balanced released support for Solana, its tenth blockchain connection.

You can use Balanced on Solana to trade, transfer crypto cross-chain, and borrow bnUSD against SOL and JitoSOL.

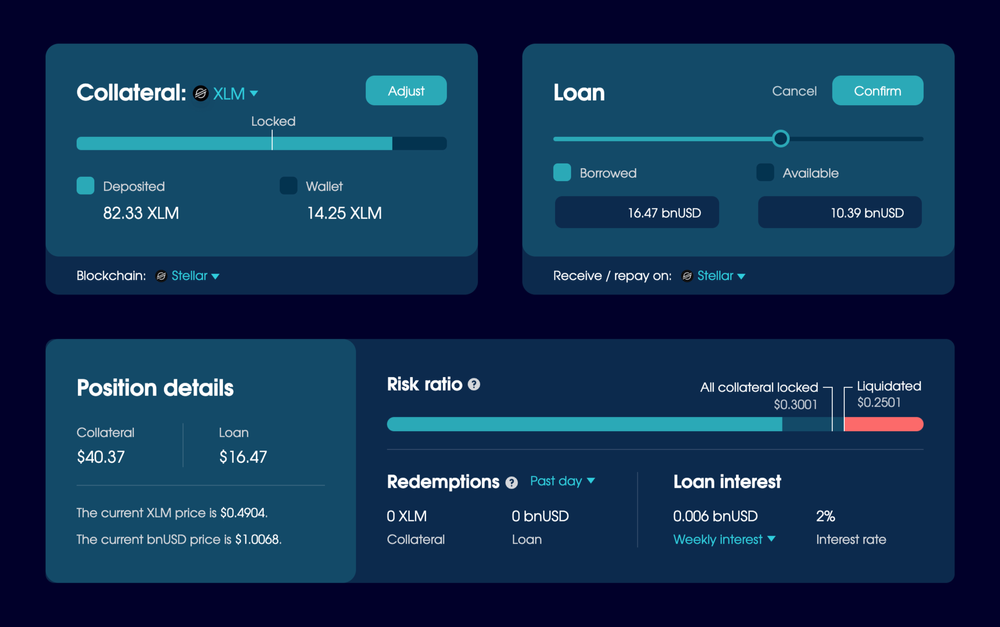

Stellar connection

Balanced released support for Stellar, its ninth blockchain connection.

You can use Balanced on Stellar to trade, transfer crypto cross-chain, and borrow bnUSD against XLM.

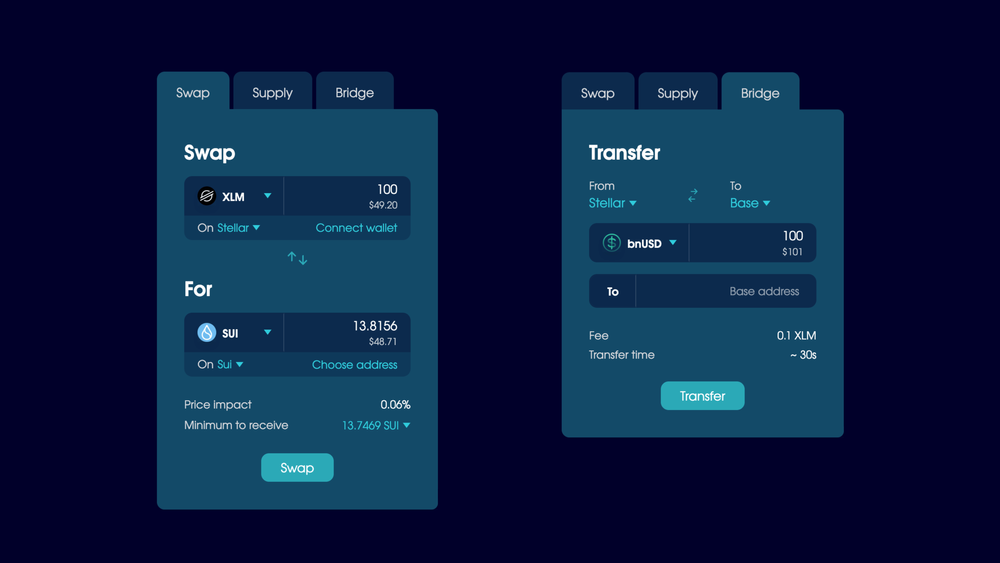

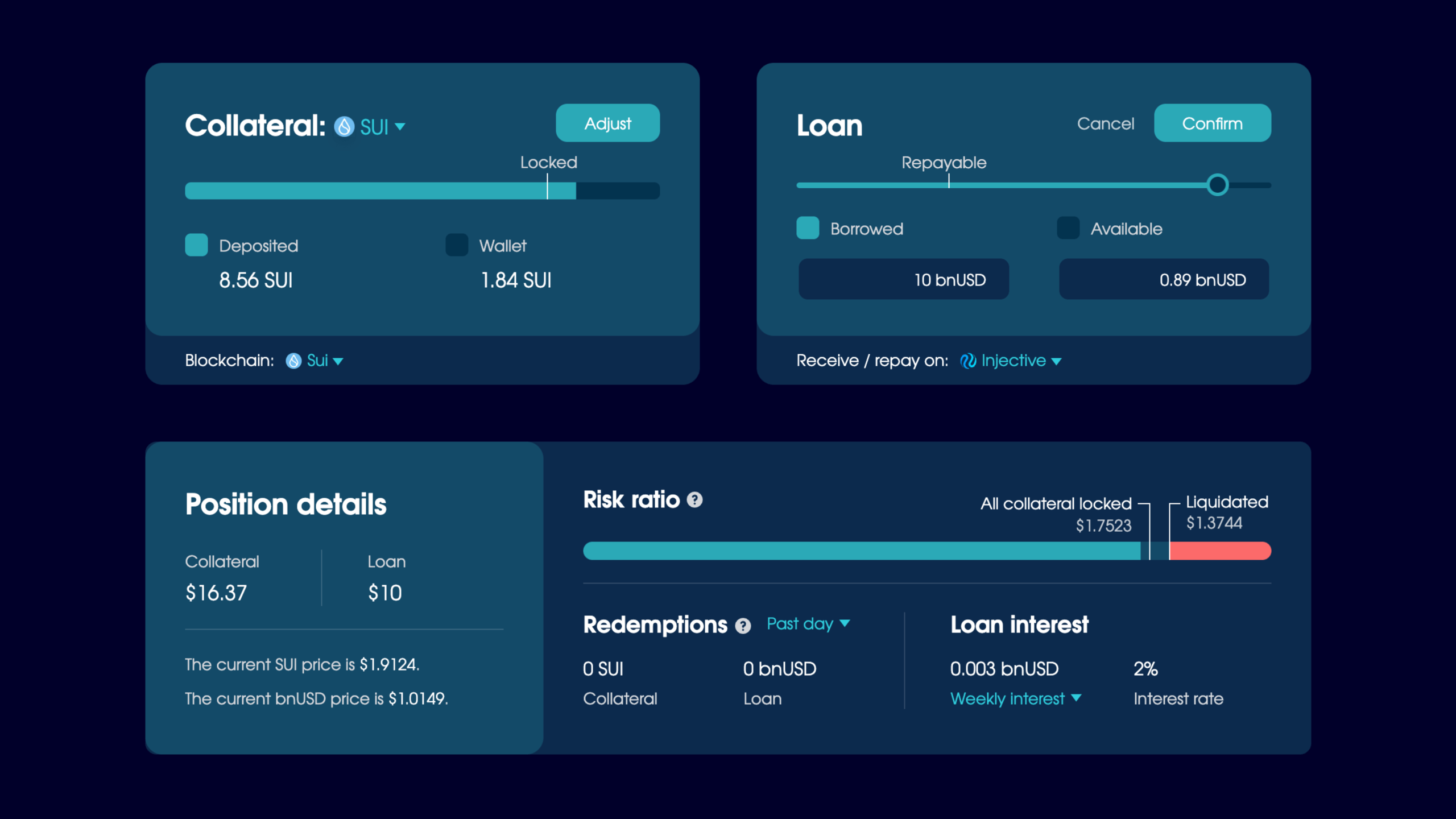

Sui connection

Balanced released support for Sui, its eighth blockchain connection.

You can use Balanced on Sui to trade, transfer crypto cross-chain, and borrow bnUSD against SUI.

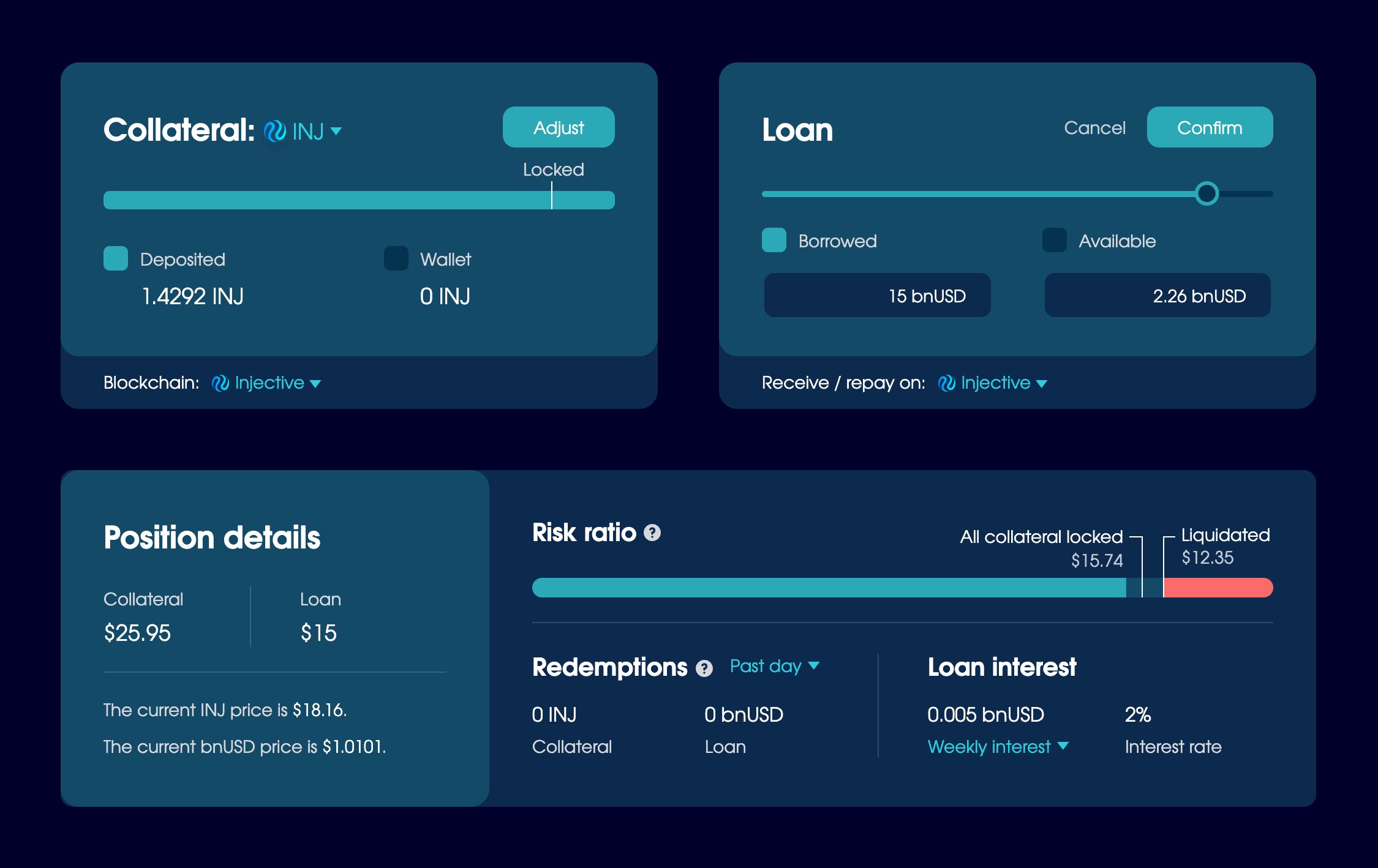

Injective connection

Balanced released support for Injective, its seventh blockchain connection.

You can use Balanced on Injective to trade, transfer crypto cross-chain, and borrow bnUSD against INJ.

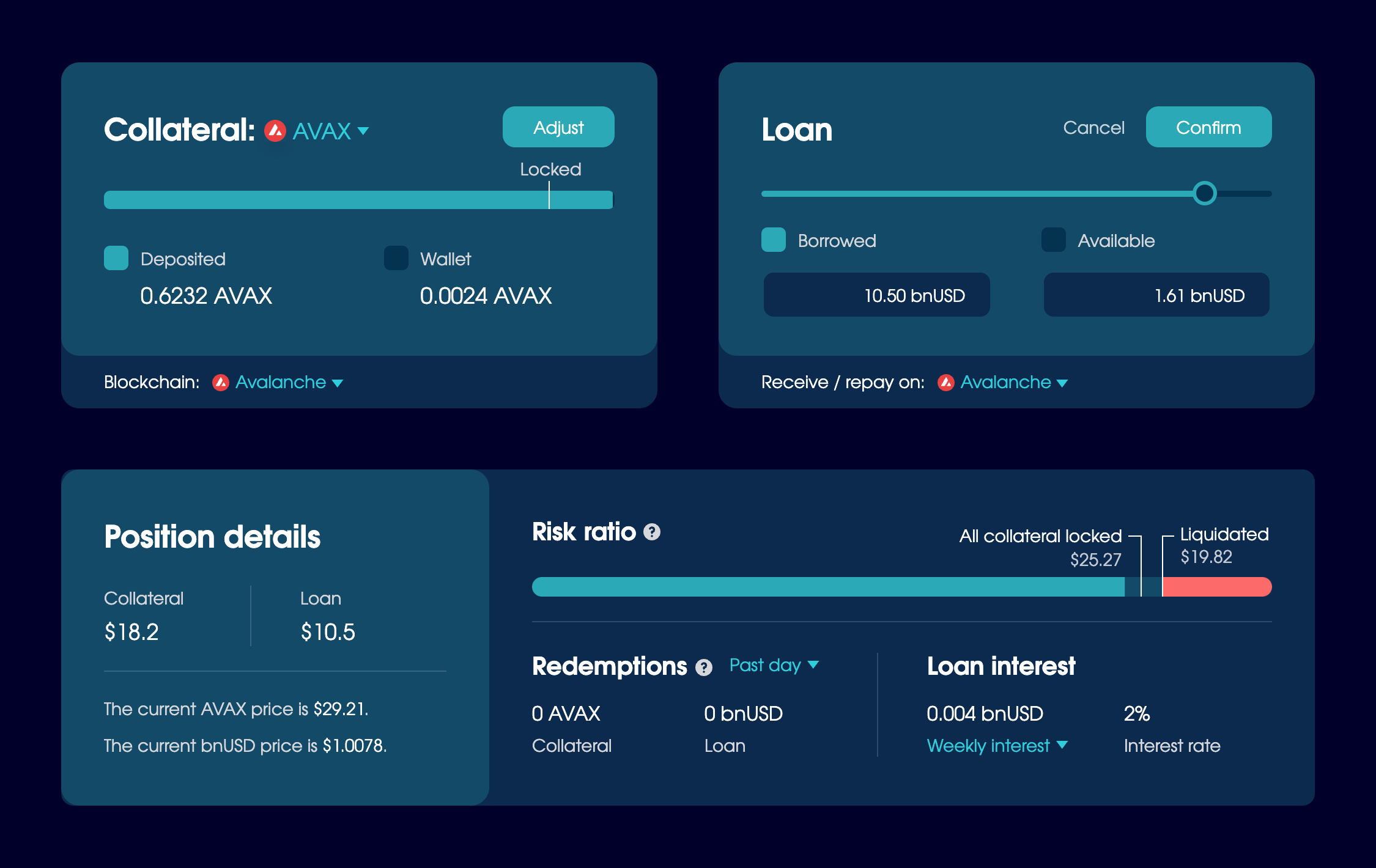

Cross-chain loans

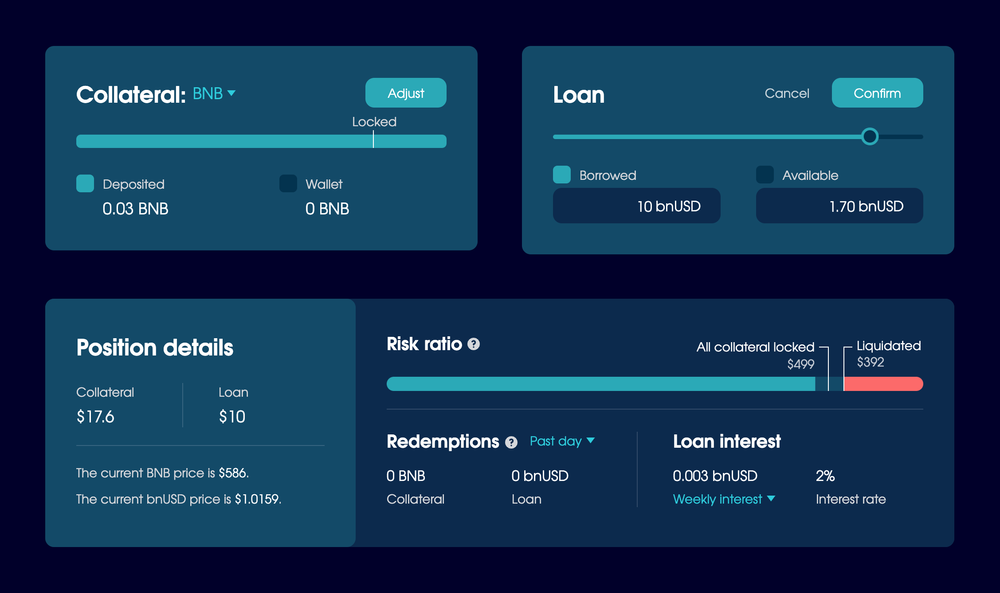

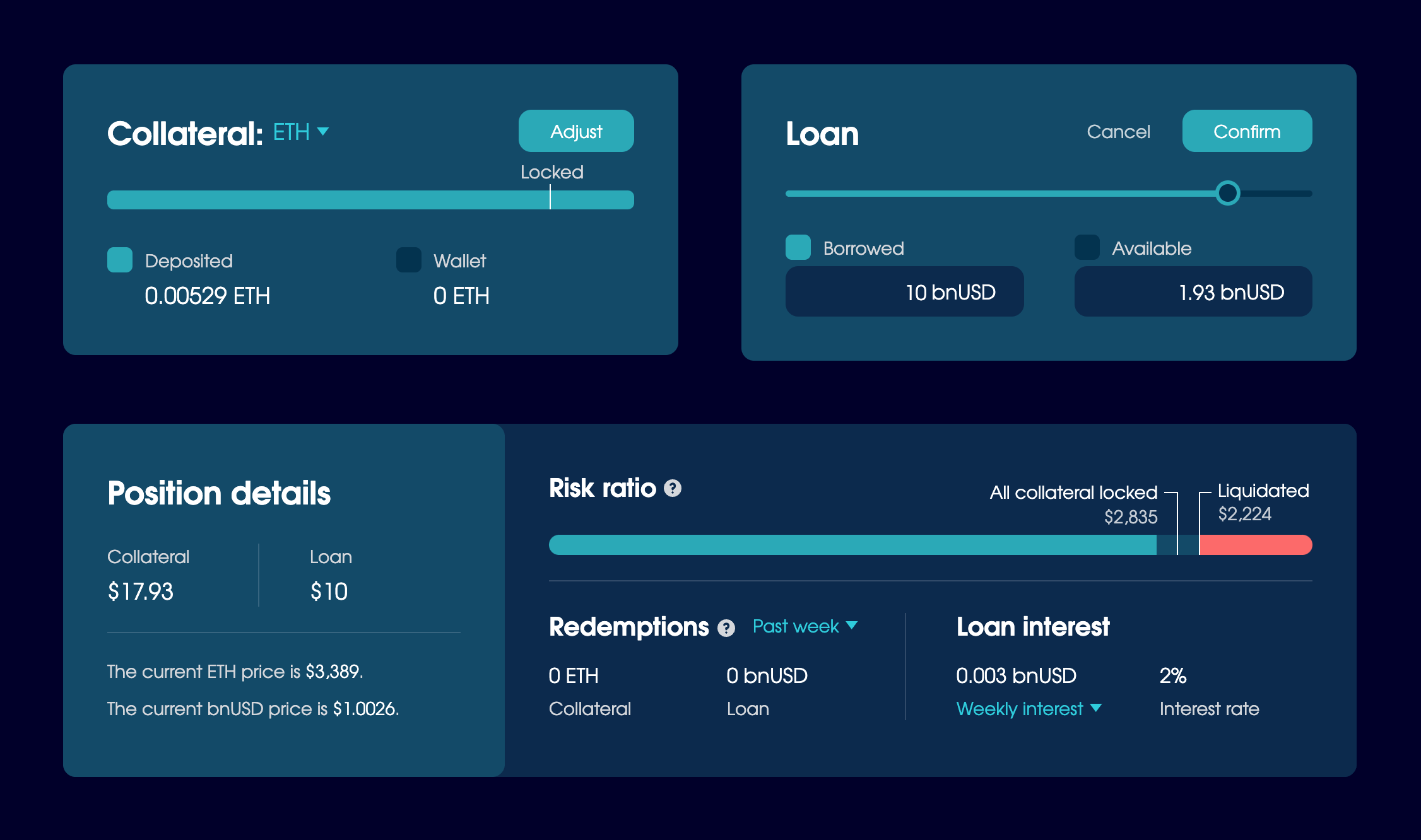

Balanced extended its support for the bnUSD loan across multiple blockchains. You can borrow bnUSD against AVAX on Avalanche and ICON; BNB on BNB Chain and ICON; BTC on Arbitrum, BNB Chain, and ICON; ETH on Arbitrum, Base, BNB Chain, and ICON; INJ on ICON; and sICX on ICON.

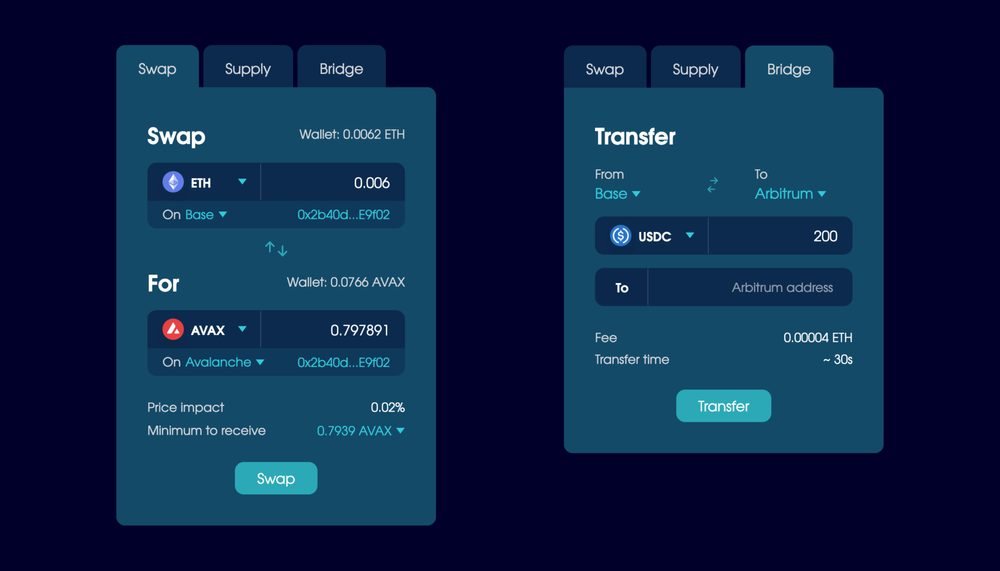

Base connection

Balanced released support for Base, its sixth blockchain connection.

You can use Balanced on Base to trade, transfer crypto cross-chain, and borrow bnUSD against ETH on ICON.

Arbitrum & BNB Chain connections

Balanced released support for Arbitrum and BNB Chain, bringing its total blockchain connections to five.

You can use Balanced on Arbitrum and BNB Chain to trade, transfer crypto cross-chain, and borrow bnUSD against ETH and BNB on ICON.

Avalanche connection

Balanced released support for Avalanche, its third blockchain connection.

You can use Balanced on Avalanche to trade, transfer crypto cross-chain, and borrow bnUSD against AVAX on ICON.

Enshrinement with the ICON blockchain

Balanced joined forces with the ICON blockchain to make Balanced a leading cross-chain DeFi protocol.

ICON planned to use its network inflation (ICX) to provide liquidity, incentivise activities within the app, and fund smart contract development. In return, Balanced would use 50% of its revenue to buy and burn ICX.

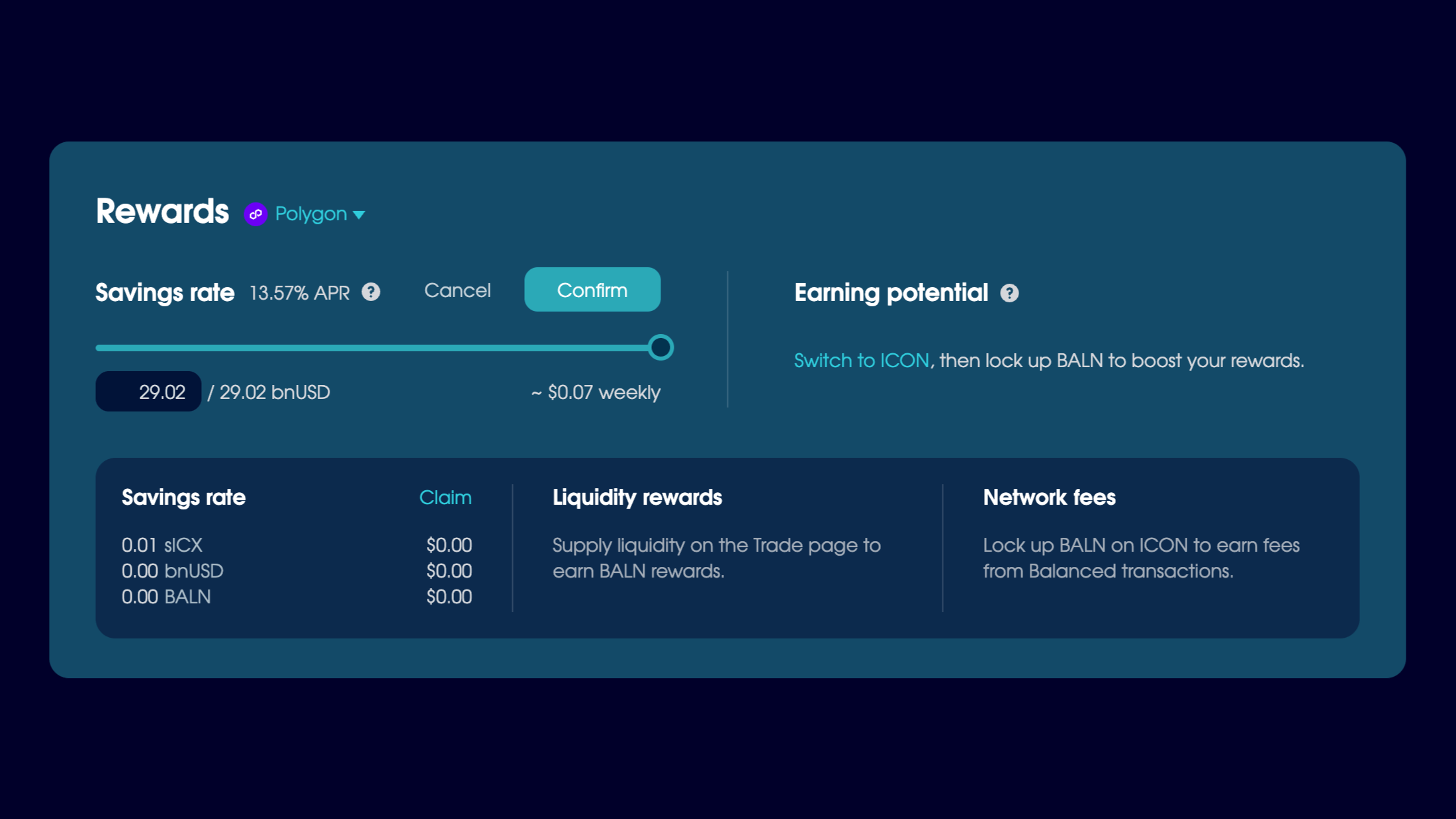

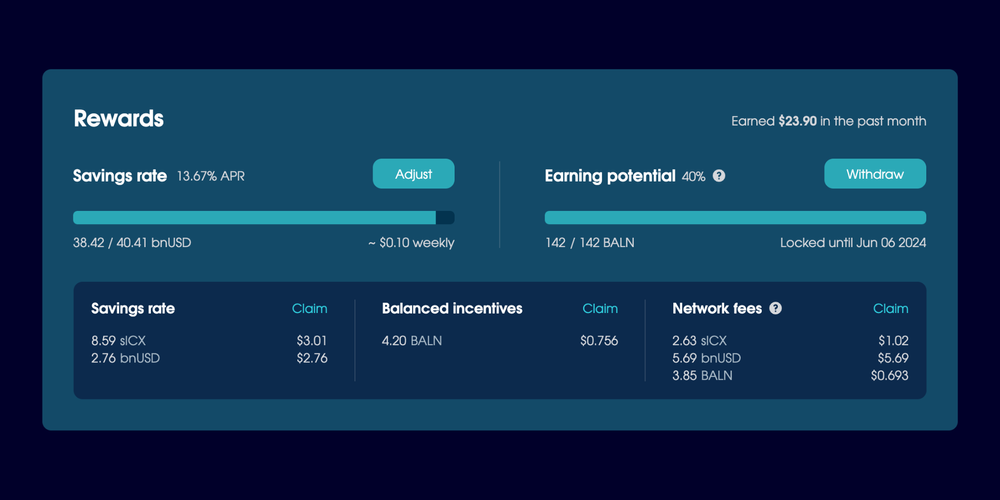

Balanced Savings Rate

Balanced added support for a new Savings Rate feature to incentivise demand for bnUSD and improve price stability. Deposit bnUSD into the Savings Rate to earn interest, paid for by bnUSD borrowers.

Cross-chain launch

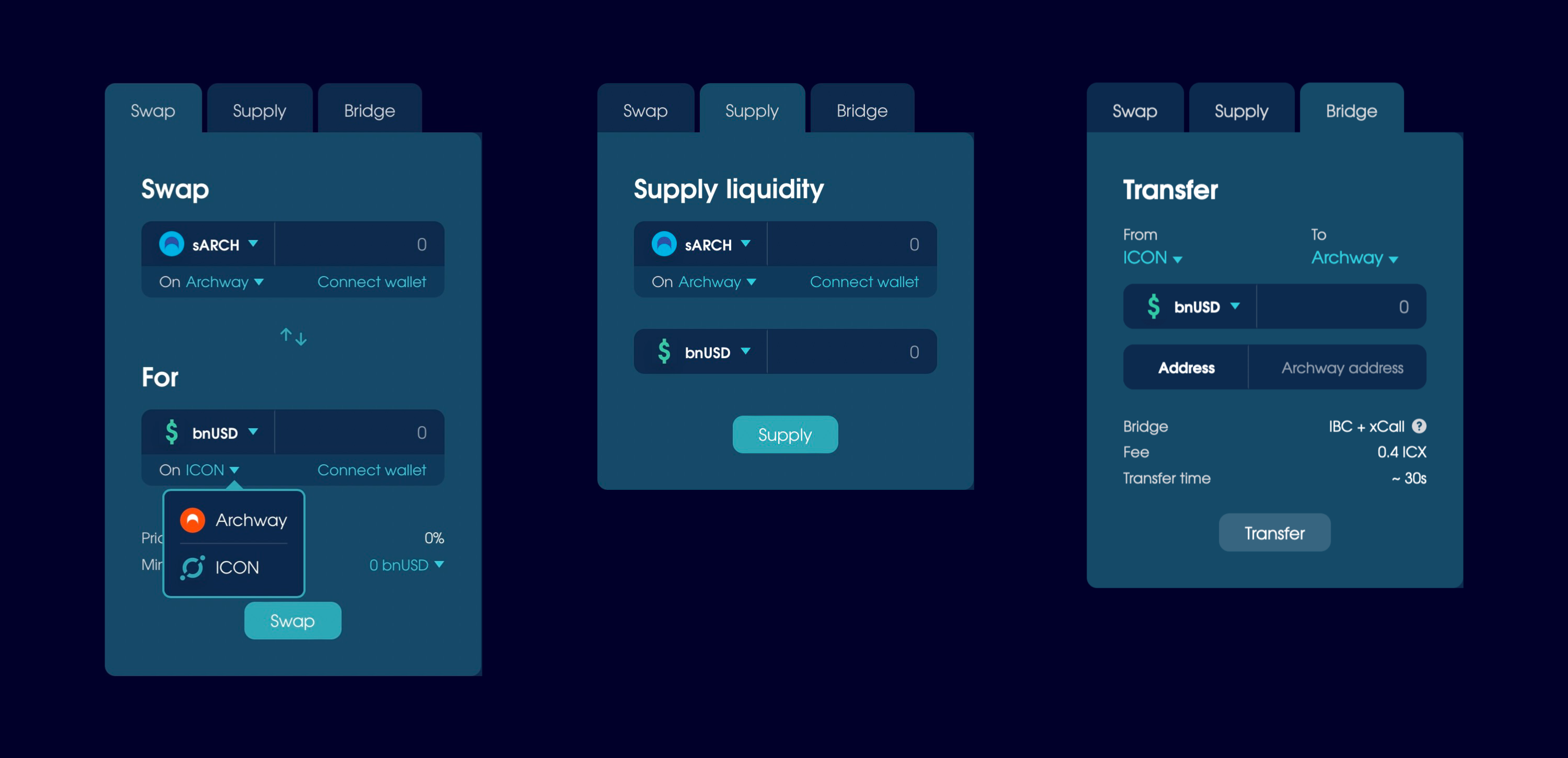

Balanced started its cross-chain adventure on Archway, which launched bnUSD and trading cross-chain.

Boosted BALN

BALN staking was replaced with a vote-escrow model popularised by Curve to align rewards and voting power with those most invested in Balanced’s long-term success.

You can lock up BALN for 1 week or up to 4 years to hold bBALN, which gives you voting power and "boosts" your earning potential. This release also included "live" voting, so bBALN holders can vote to incentivise specific liquidity pools.

Multiple collateral types for bnUSD

The Balanced app and smart contracts were updated to support for additional collateral types for bnUSD, starting with BTCB bridged from BNB Chain to ICON.

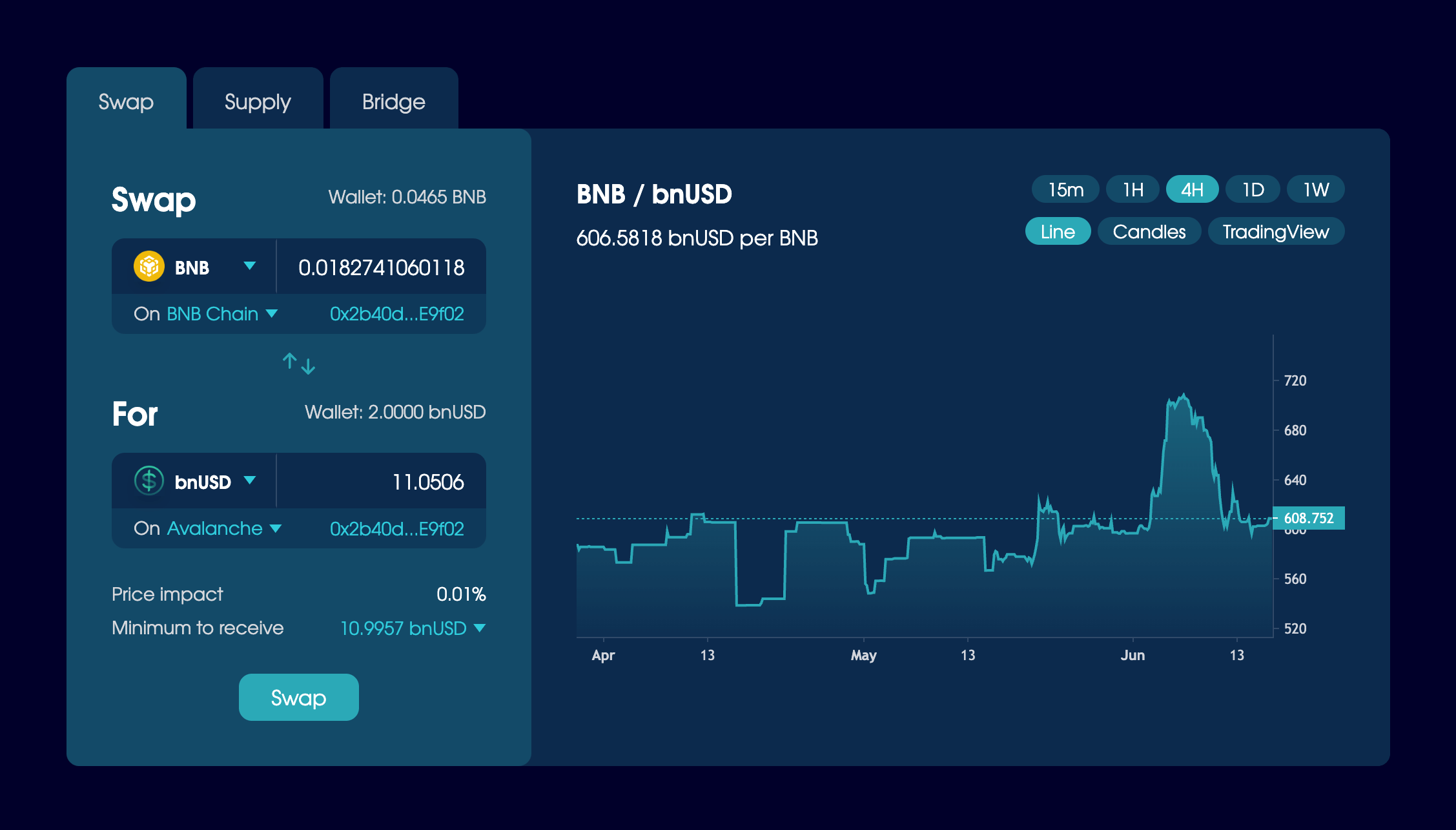

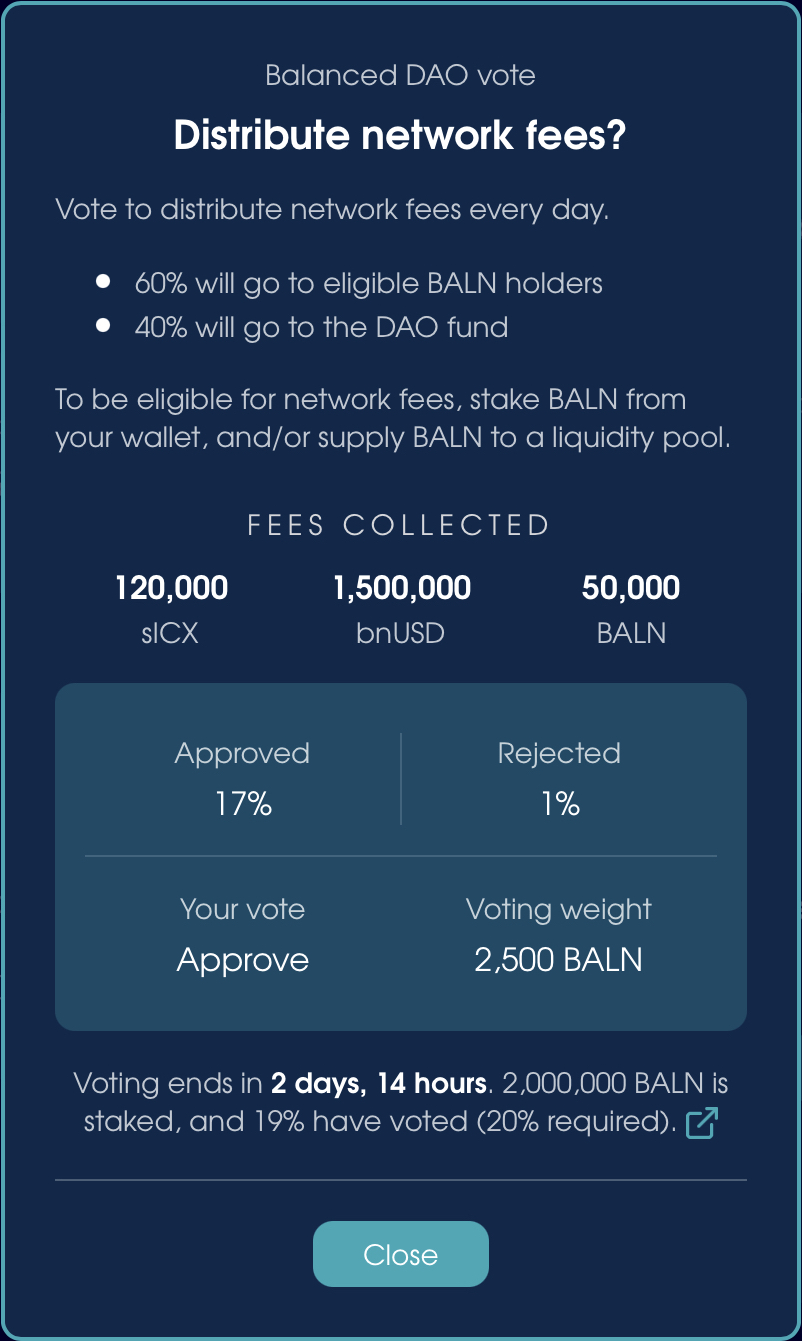

Stats page, price charts, transaction history, and the first governance proposal

With the help of our backend partner, Geometry Labs, this release added features we couldn’t squeeze into the launch: a Statistics page, price charts for the exchange, and an Activity History section.

It also included a vote to distribute over $1.5 million in fees, which Balanced earned within two months post-launch.

Balanced launch

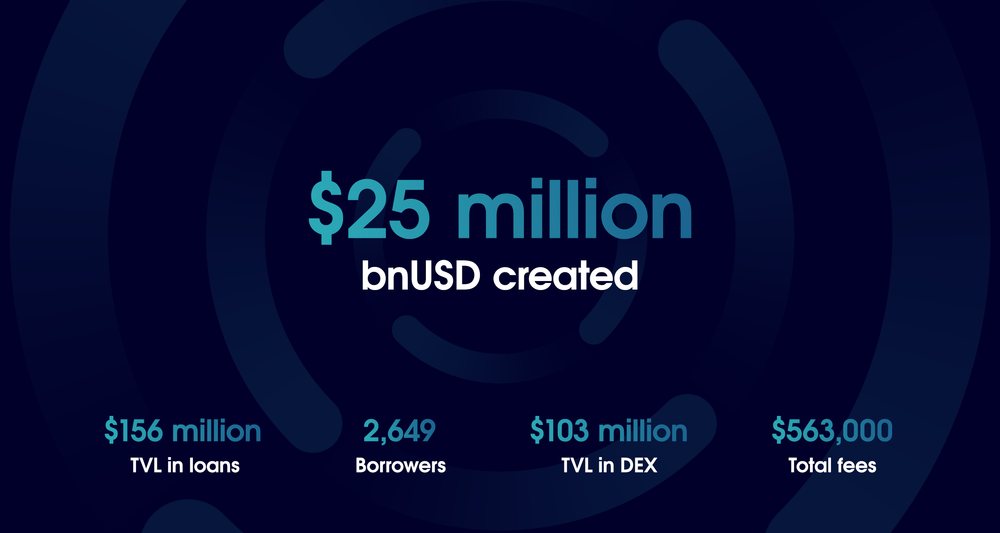

Balanced launched on the ICON blockchain with bnUSD loans backed by a single asset (ICX) and an exchange that supported 3 liquidity pools.

Within 2 weeks, people had deposited more than $250 million into the protocol (including more than 10% of the ICX circulating supply), and borrowed more than 25 million bnUSD.